Exploring HIBT Vietnam Bond Market Liquidity Reports via TechCryptoDigest

Exploring HIBT Vietnam Bond Market Liquidity Reports via TechCryptoDigest

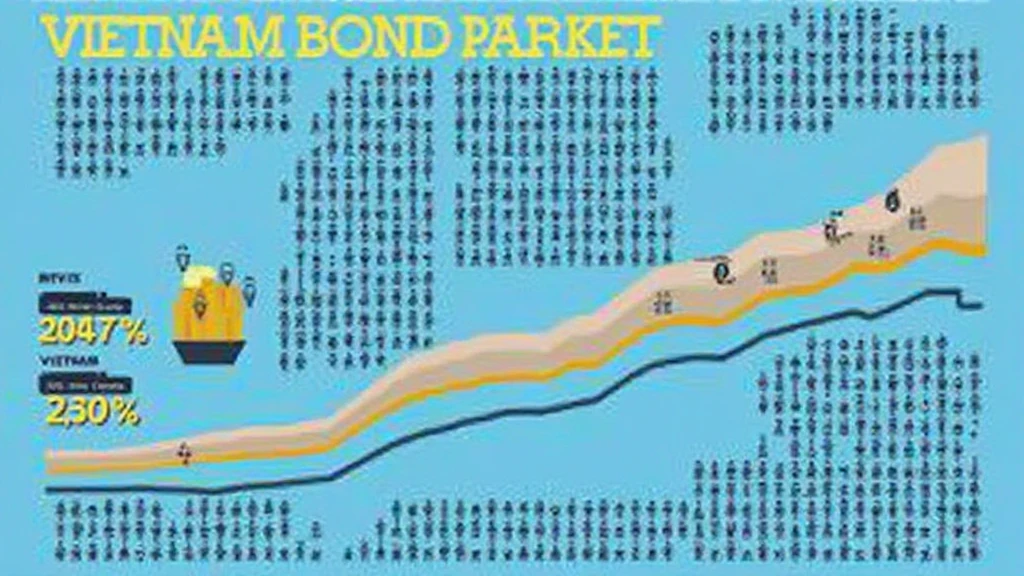

With the ongoing evolution of financial markets, including a rise in blockchain technology applications, understanding bond market liquidity is more crucial than ever. In Vietnam, the bond market has demonstrated remarkable growth, marked by an increasing number of participants and transactions. This article aims to dissect the liquidity reports provided by HIBT Vietnam, presenting essential findings that can guide investors in making informed decisions.

Understanding Bond Market Liquidity

Bond market liquidity refers to the ease with which bonds can be bought or sold in the market without causing significant price changes. In a liquid market, assets can be converted to cash quickly and with minimal price impact. In Vietnam, the bond market has seen a growth rate of 15% annually, driven by both local and foreign investments. According to recent data from HIBT, the liquidity of Vietnam’s bond market reached over $25 billion in trading volumes last year.

What Influences Bond Market Liquidity?

- Market Depth: A larger number of buyers and sellers typically leads to higher liquidity.

- Investor Confidence: Stable economic policies improve investor sentiment, increasing participation.

- Regulatory Environment: Compliance with regulations and promoting transparency can enhance market trust.

Vietnam’s Unique Market Landscape

The Vietnamese bond market operates uniquely compared to other Southeast Asian nations. The government actively issues bonds to fund infrastructure projects, creating vast opportunities for investors. Furthermore, as Vietnam continues to integrate within the ASEAN Economic Community, the increase in cross-border investments significantly enhances overall liquidity. This migration towards a more digital approach has also led to adopting blockchain technology for bond trading, creating more efficient processes.

Emerging Trends in Vietnam’s Bond Market

As highlighted by HIBT, several trends are reshaping the landscape of Vietnam’s bond market:

- Increased Adoption of Technology: Platforms leveraging blockchain technology (‘tiêu chuẩn an ninh blockchain’) are emerging, offering new levels of transparency and security.

- Foreign Investment Surge: With Vietnam’s bond yields attracting international investors, the competition for liquidity will continue to increase.

- Sustainable Investing: Environmental, social, and governance (ESG) considerations are becoming important, prompting the issuance of green bonds.

Analyzing HIBT Vietnam Bond Market Liquidity Reports

In examining the most recent HIBT reports, we uncover essential insights into bond market dynamics. Reports highlight that:

- The liquidity ratio of government bonds stands at 78% as of 2025, implying strong market health.

- Corporate bonds showed improvements, with a liquidity ratio of 65% driven by strong demand from institutional investors.

- The average time to execute transactions has decreased by 20%, indicating a significant enhancement in trade efficiency.

Practical Implications for Investors

Investors looking into Vietnam’s bond market should consider the following factors:

- Assess the underlying risks associated with specific bonds, as liquidity may vary across different issuers.

- Stay informed about economic policies that could impact market confidence.

- Explore alternative investment routes through available technology platforms.

Integrating Blockchain for Enhanced Liquidity

The integration of blockchain technology is set to revolutionize bond trading in Vietnam. Concepts like smart contracts may reduce settlement time, thereby improving liquidity. As the market matures, utilizing such technologies can provide significant advantages. Investors should keep an eye on:

- Platforms that facilitate bond tokenization, which could enhance accessibility.

- Regulatory frameworks that support blockchain applications in finance.

Future Outlook: What to Expect by 2025

According to HIBT forecasts, by 2025, the liquidity in Vietnam’s bond market is anticipated to reach $40 billion as foreign investors continue to enter the market. With regional economic integration, Vietnam’s bond market could emerge as a leader in Southeast Asia.

Conclusion

Understanding the liquidity dynamics in Vietnam’s bond market is crucial for investors. By engaging with insights from reports like those provided by HIBT, they can develop strategies to navigate the evolving landscape. The combination of technological advancements and a conducive regulatory framework presents vast opportunities for fulfilling investment objectives.

As the market continues to grow, stakeholders should stay updated with the changing dynamics, ensuring informed decision-making strategies. In this fast-moving financial environment, insights are key to success.

For more detailed information and continuous updates on Vietnam’s bond market and its liquidity status, visit HIBT Vietnam.

For those keen on leveraging advances in technology to maximize investment potential, always remember to consult local financial experts. This isn’t financial advice, and it’s crucial to keep abreast of compliance requirements.

Written by Dr. Jane Smith, a financial analyst specializing in blockchain technology and its applications in traditional finance. With over 15 published papers and leading audits for renowned blockchain projects, her expertise offers valuable insight into the integration of technology within emerging markets.