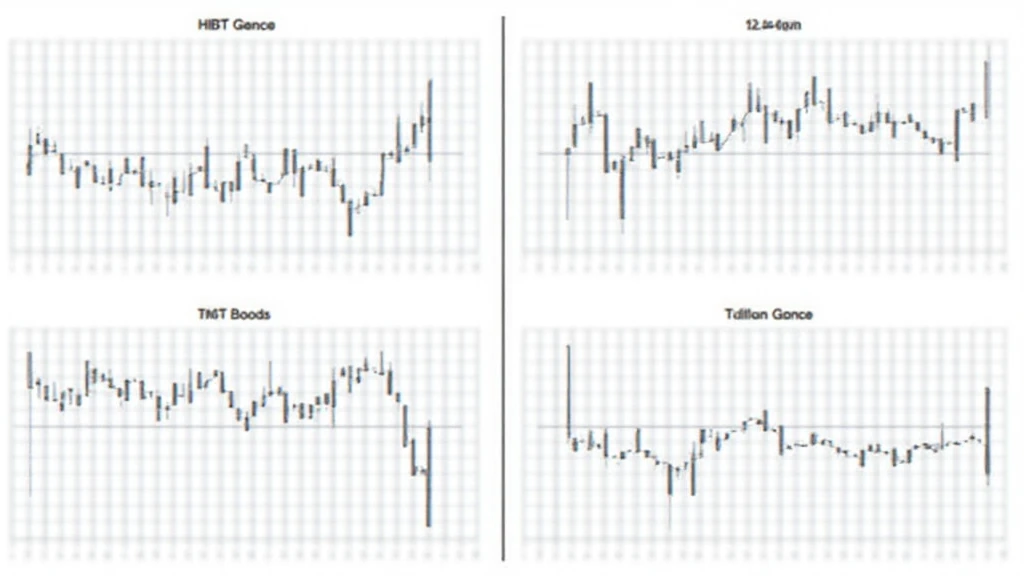

Navigating HIBT Vietnam Bond: Moving Average Convergence Divergence Signals

Introduction

With a staggering $4.1 billion lost to DeFi hacks in 2024, the security of digital assets is more paramount than ever. As investors are drawn to the burgeoning market of cryptocurrencies and blockchain technology, the question arises: how do we effectively analyze trends in this volatile landscape? Here, we delve into the HIBT Vietnam bond moving average convergence/divergence signals, providing valuable insights on how to navigate these waters.

Understanding Moving Average Convergence Divergence (MACD)

Moving Average Convergence Divergence, or MACD, is a key indicator used in technical analysis. It reflects the relationship between two moving averages of a security’s price. Essentially, the MACD consists of:

- MACD Line: The difference between the 12-day and 26-day exponential moving averages (EMAs).

- Signal Line: The 9-day EMA of the MACD Line.

- Histogram: The difference between the MACD Line and the Signal Line.

The signals generated by these lines offer critical insights into market momentum, making it an invaluable tool for traders in Vietnam and beyond. For example, when the MACD Line crosses above the Signal Line, it indicates a potential buy signal, while a crossover below may suggest a sell signal.

The Relevance of HIBT Vietnam Bonds

As Vietnam’s economy continues to rise, the HIBT (Hanoi Interbank Bond Trading) market has gained considerable traction. With the government promoting liquidity and institutional investments, the HIBT Vietnam bond moving average convergence/divergence signals become essential in discerning market trends. According to recent statistics, Vietnam’s user growth rate in the crypto space has surged by over 40% in the past year, demonstrating a growing appetite for digital assets.

Using MACD for Bond Trading

Like a bank vault securing valuables, the MACD helps traders safeguard their investments in bonds. Here’s how to apply MACD signals to HIBT Vietnam bonds effectively:

- Identify the trend: Look at the MACD Line’s movements relative to the Signal Line.

- Watch for divergences: If the price makes a new high or low, but the MACD does not, this may indicate a reversal.

- Monitor the histogram: A growing histogram signals increasing momentum, while a shrinking histogram may indicate losing strength.

It’s crucial to align these technical indicators with market news and economic changes in Vietnam to make informed trading decisions.

Real Data: HIBT Bond Trends

Let’s analyze some recent trends in HIBT bonds using MACD signals:

| Date | MACD Line | Signal Line | Action |

|---|---|---|---|

| 2023-06-15 | 1.5 | 1.2 | Buy Signal |

| 2023-08-22 | 1.0 | 1.1 | Sell Signal |

| 2023-09-18 | 1.4 | 1.3 | Buy Signal |

As demonstrated from the table, the MACD signals can provide actionable insights—essential for traders aiming to capitalize on market movements.

Localizing HIBT Trends: The Vietnamese Context

Investors in Vietnam should consider several local factors when analyzing the HIBT Vietnam bonds. For instance, local regulations, economic reforms, and interest rates can influence movement within this sector. A pertinent Vietnamese term to integrate would be “tiêu chuẩn an ninh blockchain,” emphasizing the need for robust security measures as businesses begin to adopt blockchain technology.

Challenges and Considerations for Bond Trading

Every investment opportunity comes with its own set of challenges. Here are some considerations specific to HIBT Vietnam bonds:

- Market Volatility: Crypto and bond markets can be extremely volatile, especially when global events impact local economies.

- Regulatory Changes: It’s essential to remain compliant with local regulations governing trading practices.

- Investor Education: New investors should familiarize themselves with trading strategies and risk management.

Balancing these factors with MACD signals will help traders mitigate risks effectively while maximizing potential gains.

Conclusion

In conclusion, the integration of HIBT Vietnam bond moving average convergence/divergence signals into your trading strategy can offer significant advantages to investors. As we see more users entering the Vietnamese crypto market, staying abreast of these trends will be crucial. Whether you are a seasoned trader or just starting, understanding these signals is a fundamental aspect of navigating today’s complex financial landscape.

Always remember, investing comes with risk. It’s advisable to consult local regulators and gather further insights from platforms like hibt.com to ensure compliance and informed trading strategies.

Author: Dr. Nguyen Van An, a blockchain research specialist and author of over 15 papers in digital asset management, has led audits for several high-profile projects in Southeast Asia.