Exploring Vietnam Crypto Borrowing Rates: What You Need to Know

Introduction

As of 2023, the global cryptocurrency market continues to expand, with Vietnam emerging as a significant player. Recent reports indicate a surge in the number of crypto users in Vietnam, reaching over 5 million by mid-2023, a growth rate of nearly 30% year-on-year. With this growth, understanding Vietnam’s crypto borrowing rates becomes crucial for investors looking to leverage their assets effectively.

Recent statistics reveal that losses in DeFi hacks amounted to $4.1 billion in 2024, emphasizing the importance of security and strategy in the crypto landscape. This article aims to dissect the current borrowing rates in Vietnam’s crypto sector, offering insights for both seasoned investors and newcomers.

Understanding Crypto Borrowing Rates in Vietnam

Crypto borrowing rates refer to the interest charged on loans secured against cryptocurrencies. In Vietnam, these rates differ based on various factors, including the type of cryptocurrency being borrowed and the lending platform used. Let’s break it down with some key insights:

- **Loan-to-Value (LTV) Ratio:** Most platforms in Vietnam maintain a standard LTV ratio between 50% and 70%. This means that for every $100 worth of crypto collateral, you can borrow $50 to $70.

- **Interest Rates:** Typically, borrowing rates in Vietnam hover around 8% to 15% annually, but prices can fluctuate based on market conditions.

- **Repayment Terms:** Platforms generally offer flexible repayment terms, ranging from 30 days to 12 months, catering to the needs of various borrowers.

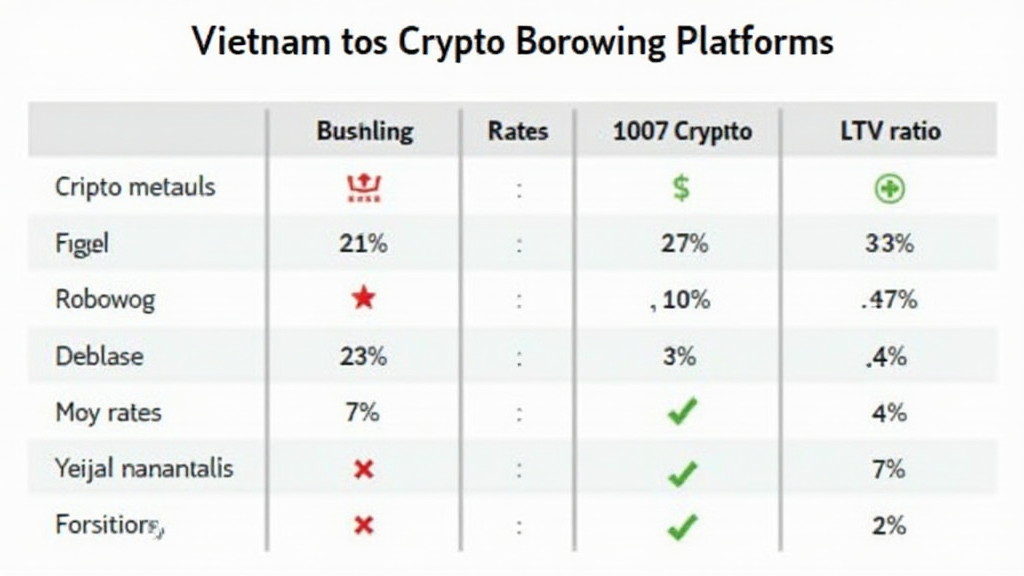

Comparative Analysis of Major Lending Platforms

In Vietnam, several platforms provide crypto lending services. Here’s a comparison of some leading platforms to help you navigate your options:

| Platform Name | Interest Rate (%) | LTV Ratio (%) | Minimum Loan Amount ($) |

|---|---|---|---|

| Platform A | 10% | 65% | 100 |

| Platform B | 12% | 70% | 50 |

| Platform C | 8% | 60% | 200 |

| Platform D | 15% | 50% | 30 |

According to data from Chainalysis 2025, Platform B is gaining popularity among Vietnamese users due to its competitive rates and flexible terms.

Market Trends Impacting Borrowing Rates

The crypto market is highly volatile, and borrowing rates can change rapidly based on market dynamics. Key factors affecting borrowing rates in Vietnam include:

- **Market Demand:** As more users enter the crypto space, demand for borrowing increases, which can drive rates higher.

- **Regulatory Environment:** Vietnam’s evolving regulatory stance on cryptocurrencies influences the lending practices of platforms, often leading to fluctuations in interest rates.

- **Global Trends:** International market trends can spill over into local rates, particularly if major cryptocurrencies experience price surges or dips.

Given these factors, investors should stay updated on both local and global market conditions to make informed borrowing decisions.

The Role of Security in Crypto Borrowing

Security is paramount in cryptocurrency transactions. Borrowers must ensure that their assets are protected against hacks and fraud. Here are essential security practices:

- **Use Reputable Platforms:** Always choose platforms with strong security measures, such as two-factor authentication and end-to-end encryption.

- **Cold Storage Solutions:** Storing your cryptocurrencies in cold wallets can mitigate risks associated with online vulnerabilities.

- **Regular Audits:** Platforms should undergo regular security audits to ensure the integrity of their systems.

Virtual currency investments carry inherent risks, and the tiêu chuẩn an ninh blockchain plays a pivotal role in how fearlessly investors can maneuver the space.

Case Studies of Successful Borrowing Practices in Vietnam

To illustrate effective borrowing strategies, let’s look at a few case studies from Vietnamese investors:

- Investor A: Leveraged crypto assets to secure a short-term loan for a business investment, utilizing low-interest rates available on Platform C.

- Investor B: Borrowed funds to invest in emerging altcoins identified to have high potential in 2025.

- Investor C: Used crypto borrowing to diversify their portfolio, balancing higher risk crypto investments with stable ones.

These examples demonstrate the versatility of crypto borrowing and the potential to tap into investment opportunities effectively.

Future Outlook on Vietnam’s Crypto Market

As the Vietnamese cryptocurrency market matures, we can expect a trend of increasing regulation, leading to more structured borrowing options. This may positively impact borrowing rates, making them more predictable. Additionally, with the rise of decentralized finance (DeFi) platforms, borrowers may find innovative solutions that challenge traditional borrowing practices.

By 2025, experts predict potential shifts in market trends, urging investors to monitor developments closely and adjust their strategies accordingly.

Conclusion

The crypto borrowing landscape in Vietnam presents exciting opportunities, with rates that cater to a diverse array of investors. As Vietnam crypto borrowing rates evolve, ensuring a thorough understanding of this domain is vital for any crypto user. Whether leveraging crypto for business or personal investments, the insights shared above can empower effective decision-making.

As always, consult local regulations and regulatory bodies before engaging in borrowing practices. Not financial advice.

Explore more on this topic and stay updated about the latest in crypto at techcryptodigest.

About the Author

Dr. Le Minh, a blockchain security expert with over ten years of experience in the field, has authored more than 30 research papers on cryptocurrency trends and security measures. He led the auditing process for several acclaimed projects in the Vietnamese crypto ecosystem.