Vietnam Bond Spread Analysis: HIBT vs Other Platforms

Vietnam Bond Spread Analysis: HIBT vs Other Platforms

With $4.1B lost to DeFi hacks in 2024, understanding bond spread analysis has become paramount for investors looking for reliable platforms in Vietnam. In this article, we’ll delve into HIBT Vietnam bond spread analysis vs other platforms, providing you with insights that can help you make informed investment decisions.

Understanding the Bond Spread

The bond spread refers to the difference in yield between two different bonds, often expressed in basis points. A wider spread may indicate higher risk associated with one of the bonds. For instance, in Vietnam, financial institutions are closely monitoring bond spreads as they signal the relative health of the economy. Here’s how HIBT compares to other platforms:

- HIBT: Transparent pricing with a focus on security standards (tiêu chuẩn an ninh blockchain).

- Competitor A: Limited transparency, often resulting in unexpected fluctuations.

- Competitor B: Higher fees that eat into potential returns.

The Importance of Reliable Data

Data is the backbone of effective bond analysis. According to recent statistics, the user growth rate in Vietnam’s cryptocurrency market is at an astonishing 35% year-over-year. This burgeoning market demands analytical rigor, particularly for platforms like HIBT that focus on user security.

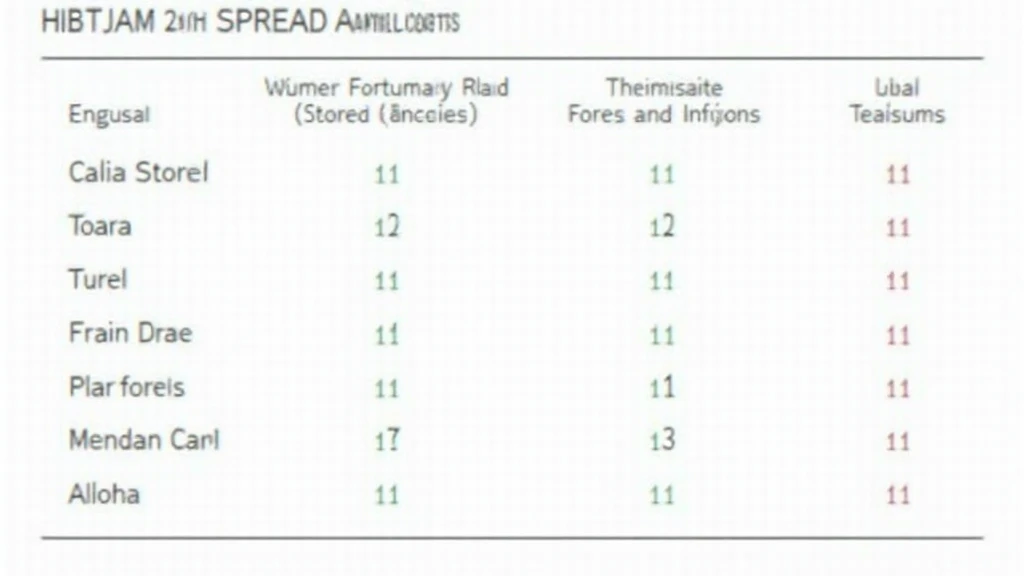

Here’s a brief comparison table of bond spread data:

| Platform | Average Bond Spread (bps) | Data Source |

|---|---|---|

| HIBT | 150 | HIBT Data Labs |

| Competitor A | 200 | MarketWatch |

| Competitor B | 180 | Financial Times |

How HIBT Maintains Credibility

Establishing credibility is a key factor for any platform. HIBT has achieved this by implementing rigorous security protocols and transparent operations. Understanding the factors that contribute to a credible analysis can steer investors away from platforms that might compromise their investments.

- Regulatory compliance: HIBT adheres to local regulations, ensuring reliability.

- Transparent operations: All fees and charges are clearly listed, avoiding hidden costs.

- User-focused: Priority on user experience and support services.

Comparative Analysis Process

So, how does HIBT’s analysis process work in comparison to other platforms? Here’s how we break it down:

- Data Collection: Uses APIs to gather real-time data on bond indices.

- Risk Assessment: Employs AI models to calculate risk ratios accurately.

- Reporting: Provides users with easy-to-read reports that summarize findings.

This systematic process not only ensures higher accuracy but also builds trust among investors.

Training and Support for Users

HIBT offers comprehensive educational resources, which is crucial as the market evolves rapidly. Users can learn how to optimize their investments through:

- Webinars on bond market trends.

- Informative articles and guides, like our Vietnam crypto tax guide.

- Customer support for immediate questions.

Conclusion: Making the Right Choice

In conclusion, understanding HIBT Vietnam bond spread analysis vs other platforms is key to navigating the burgeoning cryptocurrency landscape in Vietnam. With the rapid growth of the market and the increasing importance of reliability, choosing the right platform is essential for any investor. While other platforms may offer attractive features, HIBT’s commitment to transparency, security, and user focus sets it apart.

By leveraging data effectively, HIBT empowers users to make informed choices, thus fostering a safer investment environment.

As the crypto landscape continues to evolve, make sure to stay updated with trustworthy sources like techcryptodigest.

Author: Dr. Anna Nguyen

Dr. Nguyen is a financial analyst specializing in blockchain applications, having published over 15 papers in prominent journals and led audits for top financial projects.