Mastering HIBT’s Trailing Stop in Crypto Trading

Introduction

In a world where over $4.1 billion has been lost to DeFi hacks in 2024 alone, traders are increasingly looking for strategies that not only protect their investments but also maximize potential gains. Understanding the effective use of HIBT’s trailing stop can empower crypto enthusiasts to navigate this volatile landscape more efficiently.

As we dive deep into the mechanics of HIBT’s trailing stop and how it can be applied specifically to the growing Vietnamese market, it’s crucial for traders to be well-armed with knowledge and strategies to stay ahead.

Understanding Trailing Stops

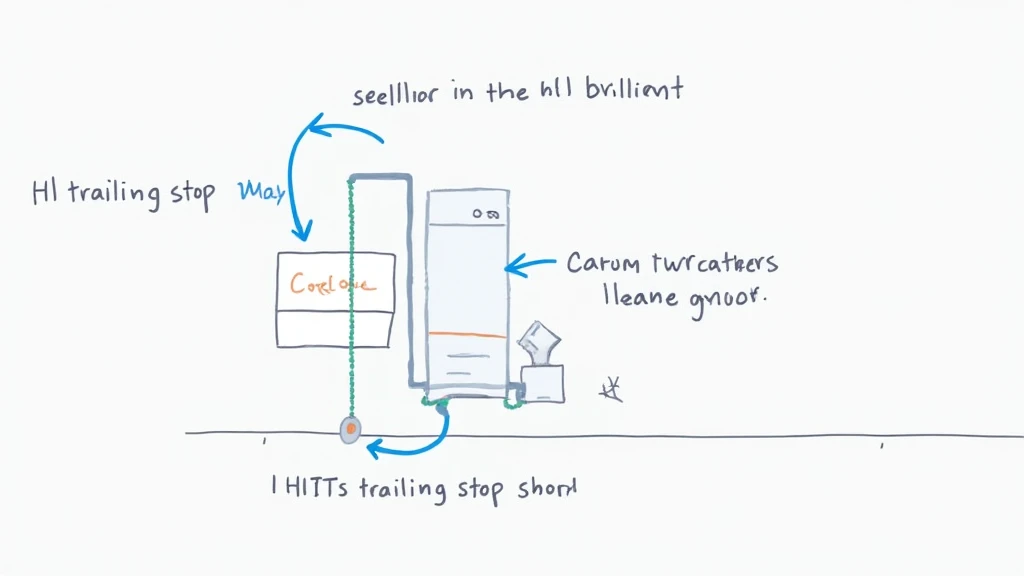

A trailing stop is a dynamic stop-loss order designed to protect gains by enabling a trade to remain open and continue to profit as long as the market price is moving in a favorable direction. Like a bank vault safeguarding physical assets, HIBT’s trailing stop lock-in profits, ensuring you aren’t completely exposed to market downturns.

Here’s how it works:

- The trader sets a stop-loss level that trails the highest price reached after entering the trade.

- As the price rises, the stop-loss price adjusts upward, thus securing more profits.

- If the price drops, the trailing stop remains where it was last set, triggering a sell order when market conditions reverse.

This method is particularly useful in the high-stakes crypto trading environment.

Setting Up HIBT’s Trailing Stop

To maximize the effectiveness of HIBT’s trailing stop in your trading strategy, follow these essential steps:

- Choose the Right Percentage: Determining a trailing stop percentage is critical. A tighter range can secure profits quickly but may get hit during normal market fluctuations.

- Understand Market Volatility: Assess the cryptocurrency’s volatility before setting your trailing stop to avoid premature sell-offs.

- Regularly Adjust Your Strategy: The crypto market behaves differently based on current events. Regularly reviewing your trailing stop settings is essential.

In Vietnam, where the crypto-language is evolving, embracing these tactical adjustments will also reflect more significant opportunities.

Benefits of Using HIBT’s Trailing Stop in Vietnamese Markets

The Vietnamese crypto market is expanding rapidly. As per recent studies, the number of crypto users in Vietnam grew by 150% in the past two years alone. Given this rapid growth, applying sophisticated tools like trailing stops can offer numerous benefits:

- Enhanced Profit Protection: With the volatile nature of cryptocurrencies, a trailing stop can safeguard your earnings during market dips.

- Freedom from Constant Monitoring: Once set, HIBT’s trailing stop can automate your exit strategy, allowing you to focus on new opportunities.

- Increased Emotional Control: Trading can evoke strong emotions. A trailing stop mitigates decisions made in a panic.

As we consider the broader implications for Vietnamese traders, it becomes evident that utilizing sophisticated tools like HIBT’s trailing stop enhances overall trading strategies in an evolving market.

Real-World Examples of Successful Trailing Stop Strategies

Here are a few scenarios where traders applied HIBT’s trailing stop effectively:

- Example 1: A trader entering the market at $50, setting a trailing stop at 10%, profited when the price reached $70, locking in gains before a significant retracement occurred.

- Example 2: In a more volatile market, a trader set a trailing stop at 5%, allowing for slight fluctuations while securing profits after the price peaked at $200.

The adaptability of trailing stops in various market conditions stands as a testament to its reliability in guiding trading strategies.

Frequently Asked Questions

What is the best trailing stop percentage?

Generally, a range between 5-20% works best, depending on the volatility of the asset.

Can a trailing stop guarantee profits?

While it secures profits, it’s essential to remember that it cannot entirely eliminate risks.

Why should I use trailing stops in crypto trading?

They help lock in gains while allowing for profit growth with minimal active involvement.

Conclusion

In a time when cryptocurrencies are gaining traction across the globe, including in Vietnam, knowing how to use HIBT’s trailing stop is a game changer for traders. By understanding the intricacies of trailing stops, setting them effectively, and integrating them into your trading strategy, you place yourself in a position to withstand market volatility and boost your likelihood of success.

As the crypto landscape continues to evolve, leveraging tools like the trailing stop is essential, ensuring you remain ahead of the game. For more insights and learning resources, visit HIBT.

Author: Dr. Quang V., a licensed financial analyst with over 12 published papers on cryptocurrency trading strategies and a lead auditor for prominent blockchain projects.