Understanding HIBT Maximum Drawdown in Investment Management in Vietnam

Understanding HIBT Maximum Drawdown in Investment Management in Vietnam

In the ever-evolving world of cryptocurrency, managing risks has become paramount for investors. With a staggering $4.1 billion lost to DeFi hacks in 2024, it’s evident that the landscape requires adept navigation. This article delves into HIBT maximum drawdown within the context of investment management in Vietnam, highlighting its implications and strategies for mitigation.

What is Maximum Drawdown?

Maximum drawdown refers to the largest peak-to-trough decline in the value of an investment portfolio. It is an essential risk metric for investors, particularly in the volatile cryptocurrency market. For instance, imagine uploading a savings account to a volatile market like a roller coaster; maximum drawdown is akin to the steepest drop experienced during the ride.

The Importance of Understanding HIBT

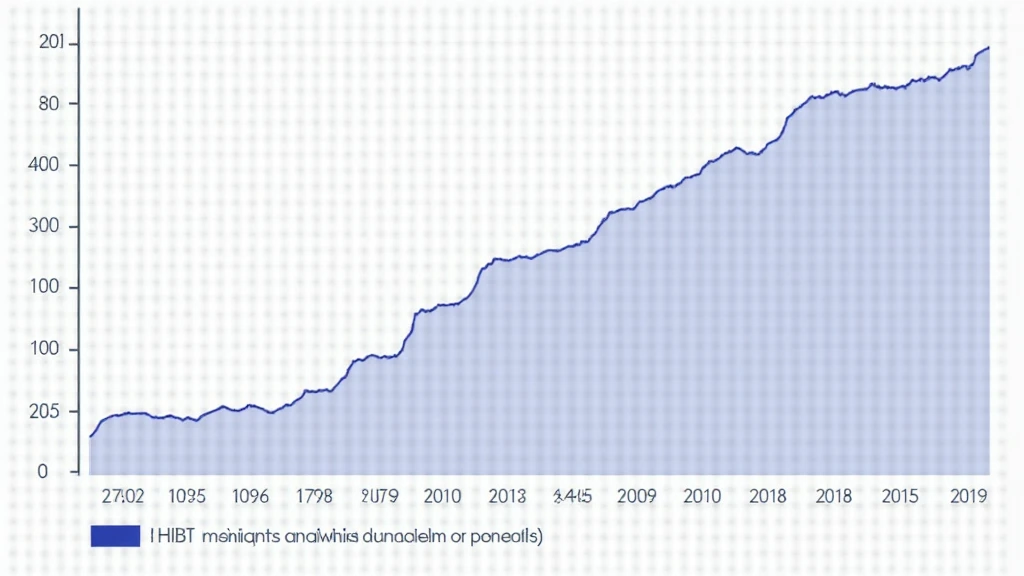

HIBT, which stands for High-Impact Blockchain Technology, plays a crucial role in how we manage investments. Understanding maximum drawdown in HIBT is vital for creating robust investment strategies, especially in Vietnam. According to a report by Statista, the Vietnamese cryptocurrency market is projected to witness a 200% growth in user adoption by 2025.

- Risk Assessment: Knowing potential maximum drawdown aids in measuring risk.

- Performance Evaluation: Maximum drawdown can be a deciding factor in evaluating the performance of HIBT investments.

- Investment Strategy: Helps in crafting strategies to mitigate drawdown impacts.

Current Landscape of Cryptocurrency in Vietnam

Vietnam has seen a burgeoning interest in cryptocurrencies, with events such as the annual Vietnam Blockchain Day drawing thousands each year. The growing popularity fuels the need for comprehensive investment management strategies that consider maximum drawdown.

Why Vietnam is a Hotspot for HIBT Investments

Vietnam’s young population and tech-savvy mindset have established it as an attractive market for blockchain technologies. As the nation embraces digital assets, the understanding of maximum drawdown becomes crucial. With the Vietnamese government showing increased support for blockchain initiatives, investors must remain informed.

Strategies for Managing Maximum Drawdown

Managing maximum drawdown involves several strategic moves:

- Diversification: Spread investments across different HIBT projects to mitigate risks.

- Asset Allocation: Choose the right mix of assets tailored to risk tolerance.

- Use of Stop-Loss Orders: Set stop-loss orders to automate selling assets during downturns.

Real Case Scenario: A Vietnamese Investment Firm

Consider a case study from a leading Vietnamese investment firm, which reported a 15% maximum drawdown on its HIBT portfolio during a market dip. By employing a diversified portfolio strategy, the firm mitigated its losses to 10% instead of 20%.

The Regulatory Environment in Vietnam

The Vietnamese government is taking steps to regulate cryptocurrencies more effectively. These regulations can significantly impact how investment firms manage maximum drawdown. Understanding these legal frameworks is vital for any investor operating in this region.

Enhancing Compliance and Security

With rising security threats in the crypto sector, firms must prioritize compliance and security measures. This is where the Vietnamese term tiêu chuẩn an ninh blockchain comes into play, emphasizing the need for robust security standards in blockchain technologies.

Tools and Technologies for Risk Management

Advanced tools can help to effectively manage maximum drawdowns:

- Blockchain Analytics Tools: Tools like HIBT provide insights into market trends and risks.

- Portfolio Management Software: Use software designed for crypto investors for better analytics.

- Educational Resources: Platforms offering courses on risk management in crypto investments.

Recommendations for Foreign Investors

For foreign investors interested in the Vietnamese market, it’s essential to collaborate with local experts who understand the cultural and regulatory context. Engaging with local advisory firms can reveal nuanced investment strategies tailored for the region.

Looking Ahead: Trends Shaping the Future

As we look towards 2025, several trends are likely to shape HIBT investments in Vietnam:

- Increased Regulation: Expect increased oversight and regulatory frameworks to evolve.

- Technological Innovations: Decentralized finance (DeFi) platforms are expected to grow, creating both opportunities and risks.

- Enhanced Security Protocols: With threats on the rise, the development of robust security measures will be critical.

Conclusion

Understanding HIBT maximum drawdown is pivotal for anyone looking to invest in Vietnam’s vibrant cryptocurrency market. As we anticipate growth and potential risks, investors must adopt comprehensive risk management strategies. Remember, the landscape is dynamic; remaining informed and proactive will enhance your investment management approach.

For further insights into managing investments and maximizing your portfolio’s potential in the realm of cryptocurrencies, visit techcryptodigest.

Author: Dr. Nguyễn Văn An, a finance researcher with over 15 published papers on blockchain investment strategies, and lead auditor for several renowned crypto projects.