Understanding HIBT Crypto Leverage Limits: Essential Insights for Crypto Traders

Understanding HIBT Crypto Leverage Limits: Essential Insights for Crypto Traders

As the cryptocurrency market continues to evolve, one pivotal factor influencing traders’ decisions is leverage. With a staggering amount of $4.1B lost to DeFi hacks in 2024 alone, understanding HIBT crypto leverage limits has never been more crucial. In this article, we’ll dive deep into what these limits mean for traders, especially in emerging markets like Vietnam.

What Is HIBT and Its Role in Crypto Trading?

HIBT stands for High-Interest Blockchain Trading, a financial instrument designed to provide traders with the ability to amplify their investments. This mechanism allows for higher returns but comes with significant risks associated with volatility in the crypto space.

Current State of Crypto Trading in Vietnam

Vietnam has emerged as a significant player in the crypto market, with an estimated user growth rate of around 40% per year. This explosive growth presents both opportunities and challenges, particularly regarding leverage trading.

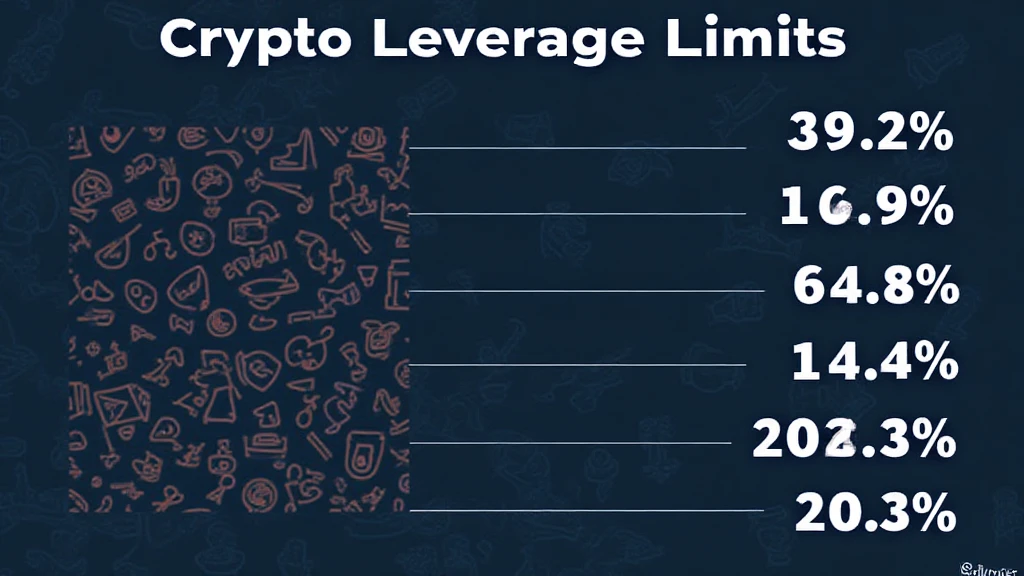

Understanding Leverage Limits

Leverage in trading is akin to borrowing funds to increase potential returns from your investments. Here’s how the leverage limits work:

- High Leverage Options: Traders can choose high leverage options that enhance their ability to magnify gains.

- Regulatory Constraints: However, regulatory bodies often set limits on how much leverage traders can use to minimize risks.

The Mechanics of Leverage Multipliers

For instance, using a leverage ratio of 10:1 means that for every $1 of your own, you can trade up to $10. This can lead to both greater profits and substantial losses. Here’s the catch: higher leverage increases your risk exposure.

Assessing Risks and Benefits of High Leverage Trading

While the allure of high returns attracts many traders, it’s essential to understand the associated risks, especially in the volatile cryptocurrency market. Consider the following:

- Market Volatility: Prices can quickly swing, leading to margin calls that require immediate additional funds or liquidation.

- Risk of Over-leveraging: This can result in significant financial losses beyond your initial investment.

Best Practices for Employing Leverage Responsibly

Traders in emerging markets like Vietnam can adopt specific practices to trade more responsibly:

- Set Clear Limits: Always know your stop-loss limits to mitigate potential losses.

- Education and Training: Taking the time to learn about leverage trading complexities can position a trader for better outcomes.

Future Trends in Crypto Leverage Trading

As we look towards 2025, the evolution of leverage limits will likely reflect regulatory developments and market conditions:

- Increased Regulations: Governments might impose stricter controls on leverage to protect investors.

- Innovation in Trading Platforms: Platforms like HIBT are expected to create new ways for traders to engage in leveraging.

What This Means for Traders in Vietnam

With Vietnam’s rapidly growing crypto market, traders must stay updated on leverage limits and adapt strategies accordingly. Leveraging responsibly can ensure that they capitalize on market opportunities while minimizing risks.

Conclusion

In conclusion, HIBT crypto leverage limits play a significant role in shaping trading strategies within the rapidly evolving cryptocurrency market. As an emerging player, Vietnam must navigate these complex dynamics while exploring the potential benefits that responsible trading can bring. Always remember, leverage isn’t just a tool; it’s a double-edged sword that requires keen awareness and strategic foresight.

For further insights on navigating the crypto landscape, visit HIBT or check out our related article on Vietnam crypto tax guidelines.