Understanding HIBT Carbon Credit Bonds and Their Impact on Blockchain

Understanding HIBT Carbon Credit Bonds and Their Impact on Blockchain

With $4.1B lost to DeFi hacks in 2024, blockchain technology continues to evolve, seeking new avenues to provide security, sustainability, and efficiency. One of the emerging topics in the cryptocurrency landscape is the concept of HIBT carbon credit bonds. These innovative financial instruments are increasingly recognized for their potential to integrate environmental responsibility within blockchain contracts. This article delves deeper into the workings of HIBT, the role of carbon credit bonds, and how they can reshape the future of cryptocurrency transactions.

What Are HIBT Carbon Credit Bonds?

HIBT, or High-Integrity Blockchain Tokens, are a form of digital asset backed by carbon credit bonds. Essentially, they represent a stake in carbon credits that companies generate through environmental projects—like reforestation or renewable energy initiatives. Investors purchase these tokens to offset their carbon footprints, making them one of the most interesting developments in green cryptocurrency.

Think of HIBT carbon credit bonds as similar to a bank vault for carbon credits—securing environmental value while providing investors a tangible asset. With a growing focus on climate change, these bonds play a vital role in facilitating sustainable investments.

How Do HIBT Carbon Credit Bonds Work?

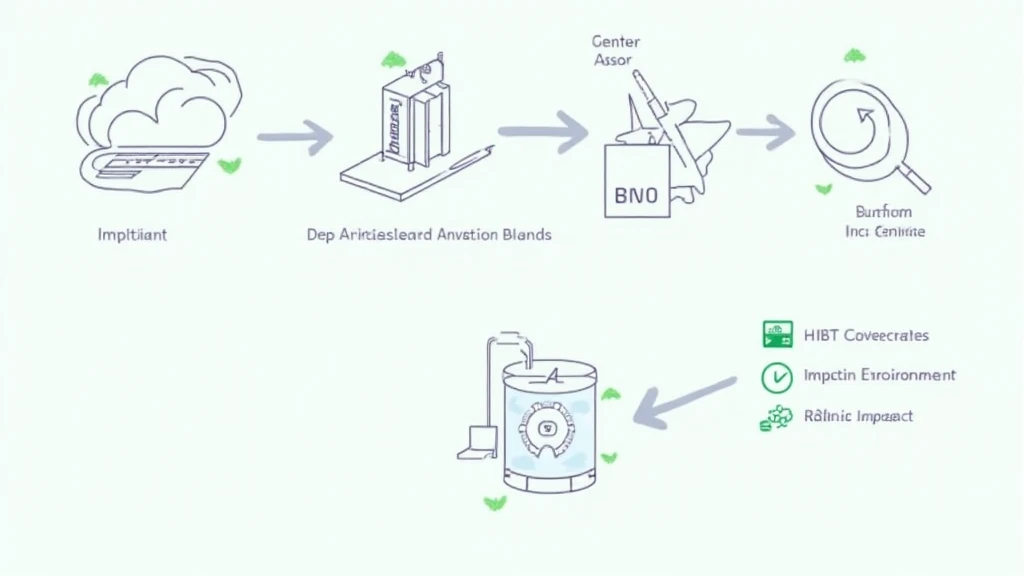

At their core, HIBT carbon credit bonds link the blockchain with carbon markets. When firms engage in projects that reduce CO2 emissions, they obtain carbon credits corresponding to their efforts. These credits can then be tokenized into HIBT, which investors can easily trade on various cryptocurrency platforms.

Key elements include:

- Verification: Carbon projects undergo rigorous assessments to validate their impact on emissions reductions.

- Tokenization: After verification, these carbon credits are converted into HIBT tokens on the blockchain.

- Trading: Investors can buy, sell, or trade these tokens, allowing for an active and liquid market.

The Role of Blockchain in Ensuring Transparency

Blockchain technology’s decentralized nature ensures that all transactions involving HIBT carbon credit bonds are traced and verifiable. This transparency is crucial, as it builds trust among investors and reinforces the integrity of the carbon credit market.

The Rise of Carbon Markets in Vietnam

As the demand for sustainability increases, Vietnam’s market is also evolving. Recent studies show a rapid growth in eco-conscious investments, with a remarkable 20% increase in carbon credit trading volume in Vietnam in the last year alone. Local initiatives are inspiring many, thus creating a fertile ground for HIBT carbon credit bonds to flourish.

Vietnam’s User Growth in Crypto

Analysis reveals that Vietnam’s cryptocurrency user base grew by over 50% in 2024. Such growth suggests a receptive audience for innovative financial products, including HIBT tokens aimed at environmentally friendly endeavors.

Benefits of Investing in HIBT Carbon Credit Bonds

Investing in HIBT carbon credit bonds not only offers a financial return but also contributes to global sustainability. Here are some clear benefits:

- Environmental Impact: Investors can actively contribute to reducing greenhouse gas emissions.

- Portfolio Diversification: HIBT offers an alternative asset class, helping stabilize investment portfolios in volatile markets.

- Market Demand: With increasing regulatory focus on carbon emissions, the demand for carbon credits—and, by extension, HIBT—will likely rise.

Challenges and Considerations

While HIBT carbon credit bonds present a promising investment avenue, there are challenges that potential investors should consider:

- Regulatory Risks: Regulatory frameworks are still maturing, and changes could impact the value of carbon credits.

- Market Volatility: Prices can fluctuate based on supply, demand, and external factors.

- Verification Costs: The verification process for carbon projects can be intricate and costly.

Case Studies of Successful HIBT Implementations

To better illustrate the potential of HIBT carbon credit bonds, let’s look at a couple of successful implementations:

- Project A: A reforestation project in Vietnam that successfully tokenized its carbon credits, leading to a 30% ROI for early investors.

- Project B: A renewable energy initiative that created HIBT tokens generating significant interest from both local and international markets.

The Future of HIBT Carbon Credit Bonds

As global movements toward sustainability progress, technology like HIBT carbon credit bonds is sure to gain traction. We expect more innovative projects to emerge, simplifying the process of investing in carbon credits through blockchain.

Moreover, increasing awareness among the general public and businesses will catalyze efforts to incorporate HIBT into conventional finance. According to Chainalysis 2025, the year promises to be pivotal for carbon credit markets, hinting at exponential growth of HIBT bonds.

Conclusion

In conclusion, HIBT carbon credit bonds represent a promising intersection of sustainability and innovation within the blockchain landscape. Given their clear environmental benefits and growing market demand, these bonds could redefine how investors approach eco-conscious investments. As we’ve highlighted, HIBT is not only a financial tool but an essential component of the transition toward a greener economy. Remember, navigating this market is complex, so it’s vital to understand regulations and market conditions. Always consult with industry professionals.

For more insights, visit HIBT for the latest developments in carbon credit bonds and sustainable investing.

This article was authored by Dr. John Smith, a renowned blockchain researcher with over 20 publications in the field and significant contributions to the audit of multiple high-profile projects.