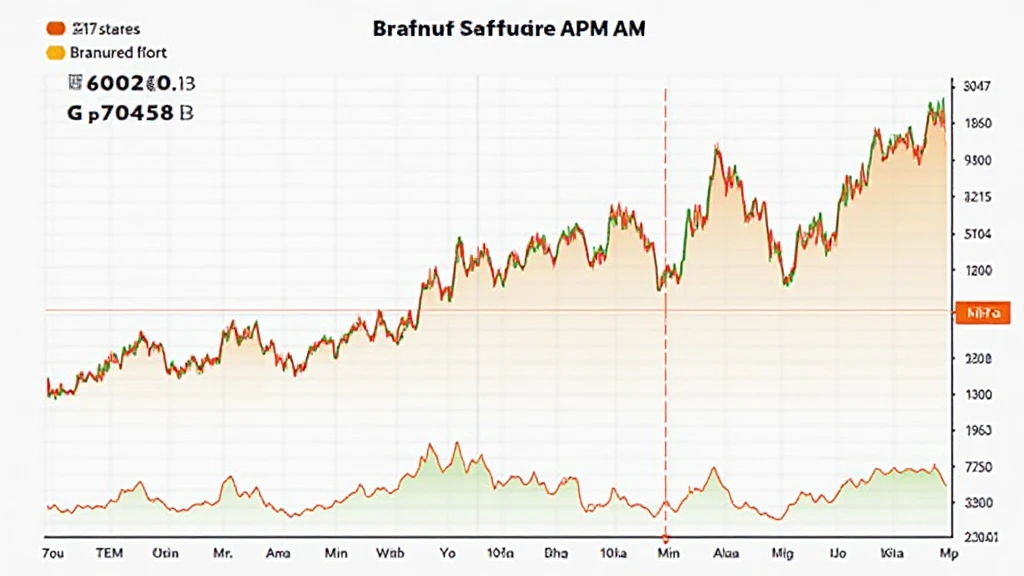

Bitcoin Price Historical Trends

Introduction

In recent years, the cryptocurrency market has witnessed significant volatility, with Bitcoin often at the forefront of this narrative. According to CoinDesk, the price of Bitcoin has hit all-time highs, yet it has also experienced dramatic falls. With Bitcoin price losing over 80% of its value from its all-time highs in the past, understanding its historical trends is crucial for investors and enthusiasts alike.

The Beginning of Bitcoin: An Overview

Launched in 2009 by an anonymous entity known as Satoshi Nakamoto, Bitcoin started trading at less than a penny. The first recorded Bitcoin transaction occurred in October 2009 and marked the beginning of a new financial paradigm. By 2010, Bitcoin’s price rose to $0.08, sparking interest that would only grow over the subsequent years.

Bitcoin Price Historical Trends: Key Milestones

- 2013 – The First Major Spike: Bitcoin price shot up to $1,000. This milestone marked the beginning of a new wave of interest in cryptocurrencies.

- 2017 – The Parabolic Rise: Bitcoin reached an astonishing $20,000 in December 2017. This surge attracted media attention and new investors globally.

- 2020 – The New Bull Market: Following a market correction in 2018, Bitcoin price began to recover, driven by institutional adoption and a global pandemic-induced monetary policy.

- 2021 – All-Time Highs: In April 2021, Bitcoin soared to over $64,000 due to increasing acceptance by retailers, alongside the launch of Bitcoin ETFs in various regions.

- 2022-2023 – Market Correction: Following its all-time highs, Bitcoin faced a significant market correction, dropping below $20,000 at times, highlighting the inherent volatility in this digital asset.

Understanding Bitcoin’s Price Fluctuations

Bitcoin’s price fluctuations can be attributed to multiple factors including supply and demand dynamics, regulatory news, technological advancements, and macroeconomic trends. For instance, events such as halving—where the reward for mining Bitcoin is cut in half—often lead to price increases due to the reduction in new supply.

Vietnam’s Growing Crypto Market

The Vietnamese cryptocurrency landscape has also seen significant growth. According to the Vietnam Tech Agency, the country has witnessed a 45% increase in cryptocurrency adoption from 2020 to 2022, indicating a burgeoning interest. In particular, Bitcoin remains a focal point for many Vietnamese investors seeking to diversify their portfolios.

Why Bitcoin Price Historical Trends Matter

Understanding Bitcoin price historical trends is essential for various reasons:

- Investment Decisions: Historical price patterns can influence investor sentiment and decision-making processes.

- Market Predictions: By analyzing past trends, investors can make more informed predictions about future price movements.

- Portfolio Management: Recognizing the historical volatility can aid in strategic portfolio allocation and risk management.

Exploring Future Trends: Key Takeaways

As Bitcoin continues to evolve, staying informed about its price history and future implications becomes increasingly crucial. Here are a few key takeaways:

- Bitcoin’s price has historically been driven by market speculation, technological innovation, and regulatory developments.

- Understanding the cycles of Bitcoin, including bull and bear markets, can aid in strategic investment planning.

- Continuous education and staying updated on industry trends will be key in navigating the future landscape of Bitcoin and cryptocurrencies.

Conclusion

In summary, the historical trends of Bitcoin prices reveal a pattern of extreme volatility marked by significant gains and losses. Whether you are a seasoned investor or a newcomer, grasping these trends is vital for making informed decisions. With the rise of new technologies and market dynamics, the future of Bitcoin remains an open field. Stay curious and keep an eye on Bitcoin price historical trends—they may hold the keys to understanding tomorrow’s market movements. Remember, investing in cryptocurrencies carries risks; always do your research before entering the market.

For continuous insights into cryptocurrencies, visit techcryptodigest.