Bitcoin Price Alert Customization: Your Guide to Smarter Trading

Introduction to Bitcoin Price Alerts

As the cryptocurrency market continues to evolve, trading strategies have become more sophisticated. In 2023 alone, the volatility of Bitcoin has caused fluctuations that are hard to ignore. With over $4.1 billion lost due to DeFi hacks in 2024, traders are looking for ways to not only protect their investments but also maximize their returns. One effective tool in every trader’s toolkit is the customization of Bitcoin price alerts.

This article aims to provide you with a comprehensive guide on how to effectively customize Bitcoin price alerts for your trading needs. We will explore various factors that impact these alerts and share insights that have been validated through extensive market research.

Understanding Bitcoin Price Alerts

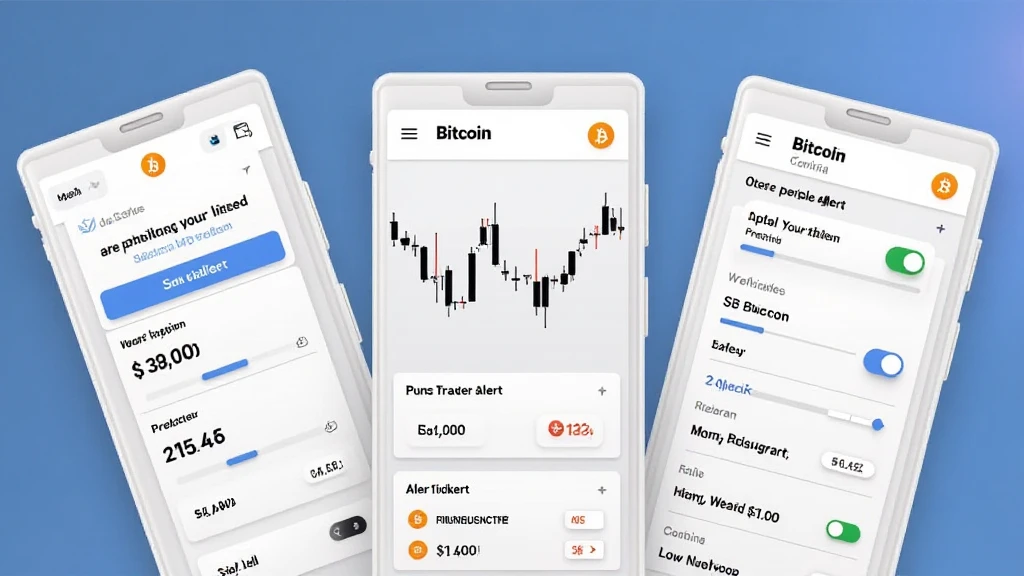

Bitcoin price alerts are notifications that inform traders when Bitcoin reaches a specific price point. These alerts can be set through various platforms, including trading apps and cryptocurrency exchanges. Just like having a security alarm system for your home, these alerts help you react swiftly to market changes.

- Real-time notifications: Stay updated on real-time price movements.

- Custom threshold settings: Choose your own price points.

- Multi-platform alerts: Receive notifications via email, SMS, or app.

For instance, a trader might set an alert to notify them when Bitcoin dips below $28,000, allowing them to buy at a lower price. This strategic planning can significantly impact your trading success.

How to Customize Your Alerts Effectively

Customizing your Bitcoin price alerts involves understanding your trading goals and risk tolerance. Here’s how you can effectively set these alerts:

- Define your limits: Establish upper and lower price thresholds based on your trading strategy.

- Use multi-trigger alerts: Combine alerts for price, volume, and market sentiment.

- Choose your notification method: Opt for instant notifications through your preferred channel.

Moreover, by analyzing market trends and historical data, you can set more informed alerts that enhance your trading strategy.

The Benefits of Customization in Trading

Bitcoin price alert customization brings various advantages to traders:

- Improved Reaction Time: Custom alerts help you respond quickly to market changes, minimizing potential losses.

- Informed Decision Making: With up-to-date information, you can make wiser trading choices.

- Stay Ahead of the Competition: Timely insights can position you strategically against other traders.

According to recent data from Statista, demand for real-time trading features has risen by over 30% in emerging markets like Vietnam. This indicates that more traders are leaning toward customization options to enhance their trading efficiency.

Local Market Insights: Bitcoin Trading in Vietnam

Vietnam’s cryptocurrency user growth rate was approximately 7% in 2023, reflecting a burgeoning interest in Bitcoin trading. This makes it imperative for local traders to utilize customized alerts to make informed decisions:

- Market trends: Vietnamese traders are particularly attentive to Bitcoin’s fluctuations due to its potential impact on the local economy.

- Alerts in Vietnamese: To better cater to the local audience, consider integrating Vietnamese language alerts for enhanced engagement.

The Vietnamese market demonstrates how essential customized Bitcoin price alerts can be for traders looking to maximize their returns.

Integrating Alerts with Trading Bots

While setting alerts is critical, combining them with automated trading bots increases efficiency:

- Automation: Execute trades immediately when alerts are triggered.

- Predefined strategies: Align alerts with specific trading strategies for better execution.

- Reduced emotional trading: Help eliminate emotional decisions during trading processes.

Let’s break it down: imagine you set an alert for when Bitcoin hits $30,000 and have a bot ready to sell once that price is reached. This seamless integration of alerts and automation can help maximize your profits.

Potential Pitfalls & How to Avoid Them

Despite the numerous benefits, there are pitfalls traders should be cautious of:

- Over-reliance on alerts: Alerts are only as reliable as the market data that informs them. Always perform due diligence.

- False positives: Price fluctuations can trigger alerts without significant market movements. Filtering your alerts can help mitigate this.

- Ignoring market context: Always consider external market conditions when trading based on alerts.

Therefore, you should remain vigilant and integrate alerts into a broader strategy for optimal performance.

Conclusion: The Future of Trading with Custom Alerts

In today’s fast-paced cryptocurrency environment, Bitcoin price alert customization is more than just a tool; it’s a necessity. As more Vietnamese users gravitate towards Bitcoin trading, incorporating tailored alerts will give you a competitive edge.

In conclusion, take charge of your trading journey by customizing your Bitcoin price alerts today. This strategy will empower you to safeguard your investments against volatility and stay informed about market trends.

For more insights and strategies, visit TechCryptoDigest, and stay ahead of the game!

—

**Author: Dr. Pham Tran**

Expert in cryptocurrency economics with over 15 publications and has led audits for several high-profile blockchain projects.