The Future of Bitcoin Peer Group Analysis: A Comprehensive Exploration

Introduction

In the rapidly evolving world of cryptocurrency, understanding market dynamics is more critical than ever. With reports indicating that over $4.1 billion was lost to DeFi hacks in 2024, investors are increasingly looking for ways to safeguard their assets. Enter Bitcoin peer group analysis, a powerful tool for evaluating the strengths and weaknesses of Bitcoin based on a comparative framework with other cryptocurrencies and traditional financial systems. This article will provide a comprehensive understanding of how peer group analysis can enhance your investment strategy and mitigate risks associated with cryptocurrency investments.

What is Bitcoin Peer Group Analysis?

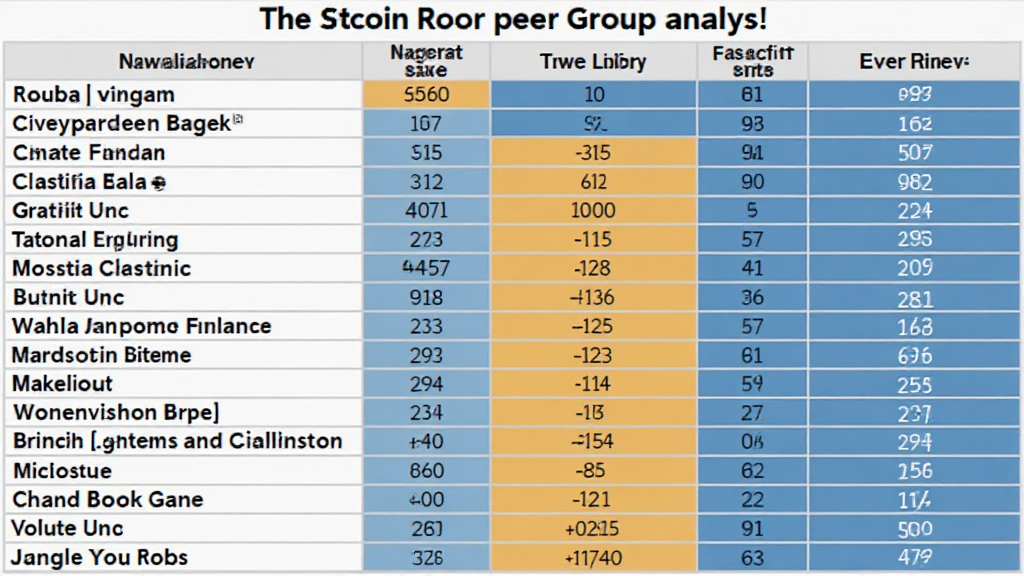

Bitcoin peer group analysis involves evaluating Bitcoin’s performance metrics in comparison to a selected group of similar cryptocurrencies. By doing this, investors can better understand Bitcoin’s market standing, overall risk profile, and potential for growth. The following points encapsulate its significance:

- Provides comparative insights against peers.

- Highlights unique strengths or vulnerabilities.

- Helps in making data-driven investment decisions.

The Components of Peer Group Analysis

Analyzing Bitcoin involves several critical components. Let’s break down these aspects to see how they interact within the cryptocurrency ecosystem:

Market Capitalization Comparison

Market capitalization is one of the primary indicators for assessing a cryptocurrency’s market value and potential. Bitcoin, with its current market cap exceeding $800 billion, often serves as a benchmark against emerging altcoins. For instance, comparing Bitcoin to potential competitors like Ethereum can highlight areas where investment might be strategically sound.

Volume and Liquidity Assessment

Understanding trading volumes and liquidity is essential because it impacts your ability to execute trades efficiently. Bitcoin usually demonstrates higher liquidity than many altcoins, making it a more stable investment during market fluctuations. Investors can analyze liquidity ratios of various coins to gauge their risk more effectively.

How to Effectively Use Peer Group Analysis

Here’s the catch: Utilizing Bitcoin peer group analysis requires not only data but also the right tools. Here are several strategies to effectively implement this analysis:

- Data Aggregation: Use platforms that compile real-time data on various cryptocurrencies, allowing for easier comparisons.

- Performance Tracking: Regularly monitor the performance of Bitcoin against its peers through volatility indices and ROI metrics.

- Trend Analysis: Identify emerging trends in altcoins that may affect Bitcoin’s performance, ensuring a proactive investment strategy.

The Role of Technology in Peer Group Analysis

Technological advancements have changed the landscape of peer group analysis significantly. For instance, blockchain technology provides transparency and security for transactions, making it easier to track historical performance data. Additionally, various specialized algorithms are the backbone of many analysis tools.

Blockchain’s Transparency

The inherent transparency of blockchain technology allows investors to audit transactions and evaluate past performances. This capability means tiêu chuẩn an ninh blockchain can be met more easily, ensuring investors have a secure information base upon which to make decisions.

AI and Data Analytics

Integrating AI into peer group analysis provides a level of sophistication previously unavailable. Data analytics platforms can analyze vast amounts of data quickly, offering insights into patterns that might not be immediately visible. This strategy enhances Bitcoin’s peer group analysis significantly compared to manual methods.

The Importance of a Robust Risk Assessment

Investing in cryptocurrencies requires a robust risk assessment. With Bitcoin characterized by significant volatility, here are a few vital considerations:

- Market Sentiment: Monitor social media and forums for investor sentiment that might impact price movements.

- Regulatory Changes: Stay updated with regulations worldwide, including Vietnam, where the user growth rate among crypto enthusiasts is sky-high.

- Technological Risks: Consider potential technical problems or forks within Bitcoin or its peer group.

Peer Influence on Investment Decisions

Just like peer pressure in social settings, the peer group analysis in cryptocurrencies can significantly influence investment decisions. Investors may feel compelled to invest in Bitcoin due to its dominating market presence compared to altcoins, affecting their diversification strategies.

Conclusion

In conclusion, Bitcoin peer group analysis is an invaluable tool for savvy investors wanting to navigate the complexities of the cryptocurrency market. With the ability to benchmark Bitcoin against its peers and the integration of advanced technologies, investors can make informed decisions based on comprehensive data analysis.

By understanding the comparative landscape of cryptocurrencies, investors can better position themselves against the backdrop of rapid market changes and security challenges. As we look towards trends shaping the future, incorporating robust analysis strategies will be key. Join the conversation around Bitcoin and crypto investment strategies as we move into a more complex financial landscape. Don’t miss out on our insights at techcryptodigest, your guide in the intricate world of digital assets.

Author: Dr. Emily Tran, a blockchain technology specialist with over 20 publications in economic analysis and consultants for major auditing projects in Vietnam.