Binance vs Coinbase Comparison: Unpacking the Leading Crypto Exchanges

Introduction

In the ever-evolving world of cryptocurrency, choosing the right exchange can make or break your trading experience. With billions of dollars traded daily and a plethora of options available, newcomers and seasoned investors alike often find themselves asking:

“Is Binance better than Coinbase, or vice versa?”

As of 2024, the crypto landscape has seen over $4.1 billion lost to security breaches, emphasizing the need for secure and reliable platforms. This guide will dive deep into the Binance vs Coinbase comparison, evaluating several critical factors to help you make a well-informed decision.

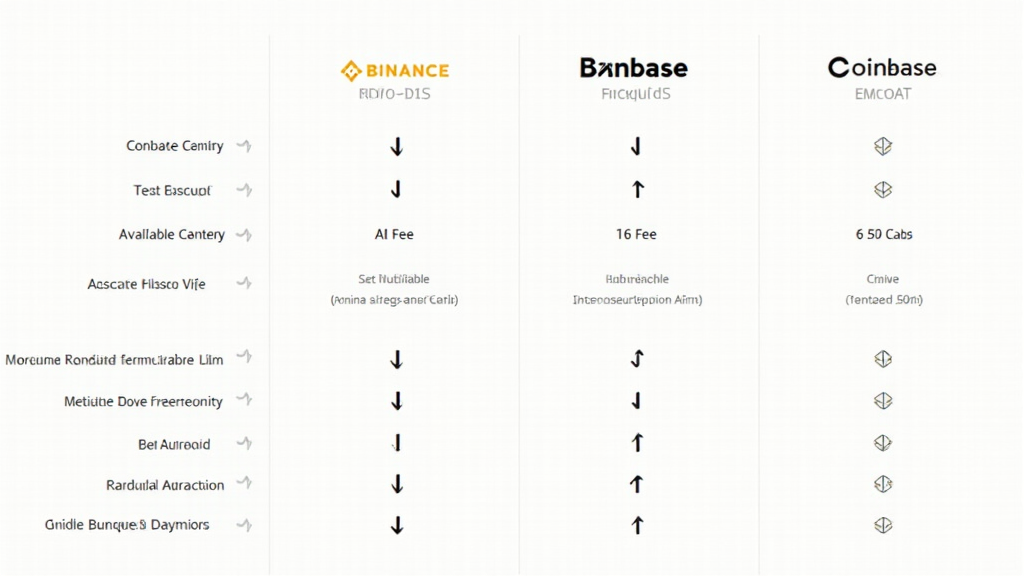

When assessing cryptocurrency exchanges, it’s vital to consider aspects like user experience, security, fees, and available cryptocurrencies. This comparison focuses primarily on Binance and Coinbase, two of the most popular platforms across the globe, including significant user growth in Vietnam.

1. Overview of Binance and Coinbase

Before we dissect the differences, let’s set the stage with a brief overview of both exchanges.

Binance was founded in 2017, quickly rising to prominence as one of the largest exchanges in the world by trading volume. Offering a vast range of cryptocurrencies, it caters to experienced traders and pros looking for in-depth trading tools.

Coinbase, on the other hand, launched in 2012 and is renowned for its user-friendly interface, which attracts beginners in the crypto market. It has heavily focused on regulatory compliance, which boosts its credibility.

2. User Experience: Interface and Usability

When comparing Binance and Coinbase, user experience plays a vital role.

Coinbase’s clean and straightforward design makes it easy for new users to navigate through the platform. It provides tutorial videos and resources that help investors get started. However, some users find transaction fees relatively high compared to other platforms.

Binance, known for its advanced charting tools, has a steeper learning curve. This can be intimidating for beginners. However, it caters excellently to advanced traders with features like futures trading. The platform has made strides to improve usability, including a simplified version intended for novice users.

According to industry statistics:

- Coinbase sees a 35% higher adoption rate among beginners in Vietnam compared to Binance.

- Binance has reported a 10% increase in user retention due to superior trading tools.

3. Security Features

Security is paramount in the cryptocurrency ecosystem, especially with several high-profile hacks making headlines.

As part of their security protocols, both Binance and Coinbase employ industry-leading practices. Coinbase vault features include multi-signature authentication, which makes unauthorized transactions difficult.

In contrast, Binance provides a comprehensive security system including:

- Two-factor authentication (2FA): Required for account access to enhance security.

- Cold storage technology: Approximately 90% of user assets are securely stored offline.

- Insurance funds: Covers losses from any security breaches.

With respect to the security standards (tiêu chuẩn an ninh blockchain), Binance has consistently improved its regulations post-2022 hacking incidents, while Coinbase remains a well-regarded entity in complying with legal standards set by regulators.

4. Fees Structure: A Comparative Analysis

Trading fees are often decisive when users choose between exchanges. Let’s break down the costs associated with both platforms.

Coinbase typically charges:

- Trading Fees: Ranges from 0.5% to 4.5% depending on the transaction type.

- Deposit Fees: Free for bank transfers but a fee is applied for credit/debit cards.

- Withdrawal Fees: Variable, based on the withdrawal method.

Binance is known for its low trading fees, structured as follows:

- Spot trading fees: Starts at 0.1% for both maker and taker.

- Discounts: Users can utilize BNB (Binance Coin) to further reduce their trading fees.

- Withdrawal fees: Typically lower relative to industry standards.

Ultimately, users looking to save on fees may lean towards Binance, while those valuing a more beginner-friendly platform might find the trade-offs on Coinbase acceptable.

5. Available Cryptocurrencies: Variety Matters

Another essential factor to consider is the selection of cryptocurrencies available on each platform.

Coinbase offers a respectable variety, supporting nearly 50 different coins. Major cryptocurrencies like Bitcoin, Ethereum, and Litecoin are readily available, along with several popular altcoins.

Binance takes the lead in diversity, featuring over 500 cryptocurrencies, including countless altcoins and emerging tokens. This vast selection facilitates users’ exploration of the burgeoning DeFi and NFT markets.

This variety has implications in the Vietnam market, where growing interest has been noted:

- A study found that 62% of Vietnamese crypto users prefer Binance for its vast array of trading pairs.

- Only 15% of them mentioned Coinbase as their platform of choice for trading.

6. Regulatory Compliance and User Trust

Regulatory compliance is increasingly pivotal as governments worldwide scrutinize the cryptocurrency market.

Coinbase consistently positions itself as a compliant exchange leader, welcoming regulatory oversight and prioritizing transparency. Its public listing on NASDAQ adds to user trust.

Conversely, Binance has faced controversy and regulatory challenges in multiple jurisdictions. Despite this, the exchange continually works to adhere to required regulations, emphasizing its commitment to becoming compliant globally.

As a user, it’s essential to weigh the risks and benefits of using a platform that is either regulated or in the process of obtaining regulatory approval. Ensuring your assets are safe should always be a primary concern.

Conclusion: Making an Informed Choice

Ultimately, the choice between Binance and Coinbase largely depends on your trading style, experience level, and personal preferences. For beginners seeking an intuitive interface, Coinbase shines as an excellent entry point. On the contrary, those willing to navigate a more intricate platform and wanting lower fees may find Binance more appealing.

In summary, it’s advisable to weigh the features offered, assess the security measures in place, and always remain aware of the evolving regulatory landscape while making your selection. Trading cryptocurrency requires knowledge and patience, so choose the platform that aligns best with your goals and preferences.

Both Binance and Coinbase continue to lead the charge in empowering users to invest in digital assets. Make an informed choice and explore the ever-growing world of cryptocurrency, but remember that no investment is risk-free. Always consult your local cryptocurrency regulations and perform due diligence before making any decisions.

For further insights and reviews on cryptocurrency platforms, visit TechCryptoDigest.

Author: Dr. Alex Kim, a seasoned blockchain researcher with over 20 published papers and a lead auditor for prominent exchanges.