Mastering HIBT Crypto Liquidity Pool Optimization

Introduction

With an estimated $4.1 billion lost in 2024 due to DeFi hacks, the urgent need for understanding HIBT crypto liquidity pool optimization has never been greater. In this article, we will explore how optimizing liquidity pools can mitigate risks, enhance trading stability, and improve profitability in the volatile world of cryptocurrency liquidity management.

The Importance of Liquidity Pools

Liquidity pools are essential for decentralized finance (DeFi), acting like a bank vault for digital assets where users contribute their cryptocurrencies to provide liquidity for traders. Let’s break it down further:

- Liquidity pools facilitate seamless transactions.

- They ensure that traders can buy or sell assets without significant price fluctuations.

For instance, in Vietnam, there has been a noticeable increase in crypto market participation, with a 25% rise in user growth reported in the last year. This demonstrates that more and more individuals are reliant on liquidity pools to engage in crypto trading.

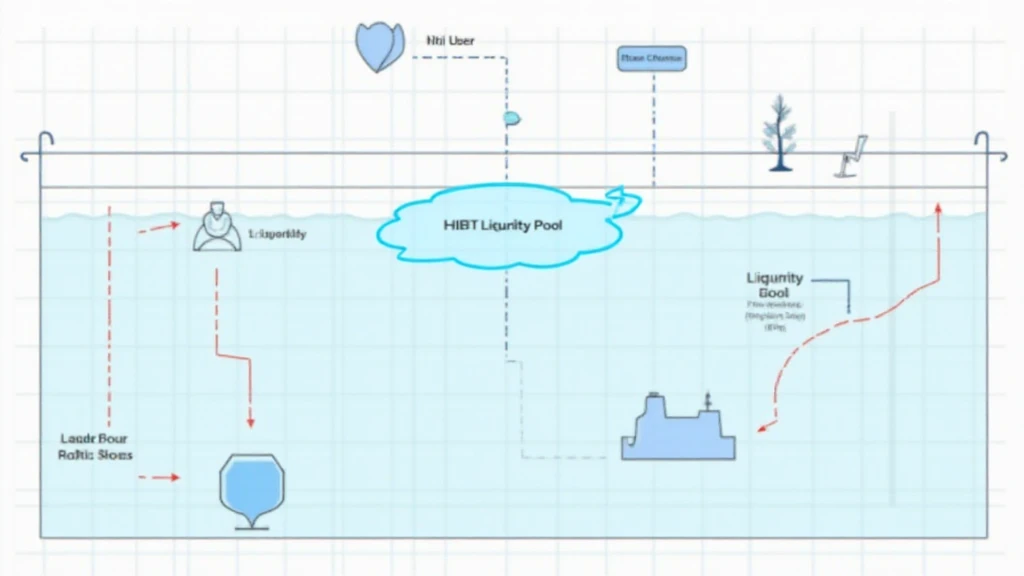

Understanding HIBT and Its Role in Liquidity Pools

HIBT (High-Interest Blockchain Token) is a pivotal element in improving liquidity pool efficiency. Here’s why it matters:

- HIBT allows users to gain higher returns compared to traditional tokens.

- It plays a crucial role in incentivizing liquidity providers.

By effectively utilizing HIBT, liquidity providers can earn significant rewards, bolstering both the pool’s health and their individual investment returns.

Strategies for Optimizing HIBT Crypto Liquidity Pools

When it comes to optimizing HIBT crypto liquidity pools, the following strategies should be taken into account:

1. Diversification of Liquidity

Diversifying your liquidity across various pools can spread risk and enhance returns. Similar to how investors diversify stocks, liquidity providers should consider allocating HIBT tokens to multiple platforms.

2. Regular Audits of Smart Contracts

Conducting regular audits of smart contracts using certified firms ensures security and compliance. This step is vital to detect vulnerabilities before they can be exploited. Some suggestions on how to audit smart contracts include:

- Utilizing predefined frameworks for evaluation.

- Selecting reputable auditing firms to handle the process.

3. Engaging with Community Feedback

Understanding and acting upon community feedback can lead to enhancements that attract more liquidity. Consider forums or social media platforms where liquidity providers discuss their experiences.

The Impact of Liquidity on Market Stability

The stability of crypto markets is inherently tied to the effectiveness of liquidity pools. Greater liquidity leads to:

- Improved price discovery

- Reduction in slippage for traders

- Enhanced confidence among investors, particularly in emerging markets like Vietnam

As of 2025, it’s projected that the growth of liquidity pools will shape the future of decentralized trading strategies.

Measuring Success in HIBT Liquidity Pool Optimization

To gauge the success of your optimization efforts, consider monitoring the following metrics:

- Transaction volumes: Higher volumes indicate effective liquidity.

- Returns on investment: Assess profit margins from liquidity provision.

- Community engagement: Positive feedback signals sustained interest.

Using advanced analytics tools can further enhance these measurements, enabling providers to adjust strategies in real-time.

Conclusion

Optimizing HIBT crypto liquidity pools is paramount for sustaining profitability and market stability in a fast-evolving industry. By focusing on diversification, regular audits, and community involvement, liquidity providers can enhance their positioning in the ever-growing crypto landscape. Don’t miss out on the chance to take your liquidity pool to new heights. Remember, securing your assets through effective liquidity management is as vital as the investments themselves.

To learn more about how to enhance your liquidity pool strategies, check out HIBT and stay ahead in the crypto game.

Author: Dr. Alex Tran, an expert in blockchain technologies, has published over 15 papers in the field and led major crypto audits for well-known projects. His insights aim to help both new and experienced investors navigate complex crypto ecosystems effectively.