Vietnam Crypto Tax Reporting: Your Essential Guide to Compliance

Introduction

In 2024, Vietnam saw a surge in cryptocurrency engagement, with over 5 million users participating in the crypto market, according to the Vietnam Blockchain Association. But with this rapid growth comes a crucial challenge: crypto tax reporting. With the Vietnamese government tightening regulations surrounding digital assets, ensuring compliance with Vietnam crypto tax reporting has never been more vital. In this article, we’ll break down everything you need to know about tax obligations for crypto users in Vietnam.

Understanding Cryptocurrency Tax Obligations in Vietnam

To effectively manage your tax responsibilities, it’s essential to grasp what constitutes taxable events in the world of cryptocurrency. While regulations can vary, here are some key points:

- Cryptocurrency transactions are subject to capital gains tax based on profit earned when trading crypto.

- Mining activities can also be taxed, classified as income.

- In some cases, receiving cryptocurrency as payment may be subject to income tax.

This landscape is akin to navigating a complex maze; understanding each path is crucial for safely arriving at your destination.

What Are Taxable Events?

Taxable events involving cryptocurrencies can include:

- Selling crypto for fiat: Recognized as capital gains based on the profit.

- Trade between cryptocurrencies: Also seen as a taxable event if gains are made.

- Using crypto for purchases: If the value of crypto has appreciated since acquisition, the surplus is considered taxable.

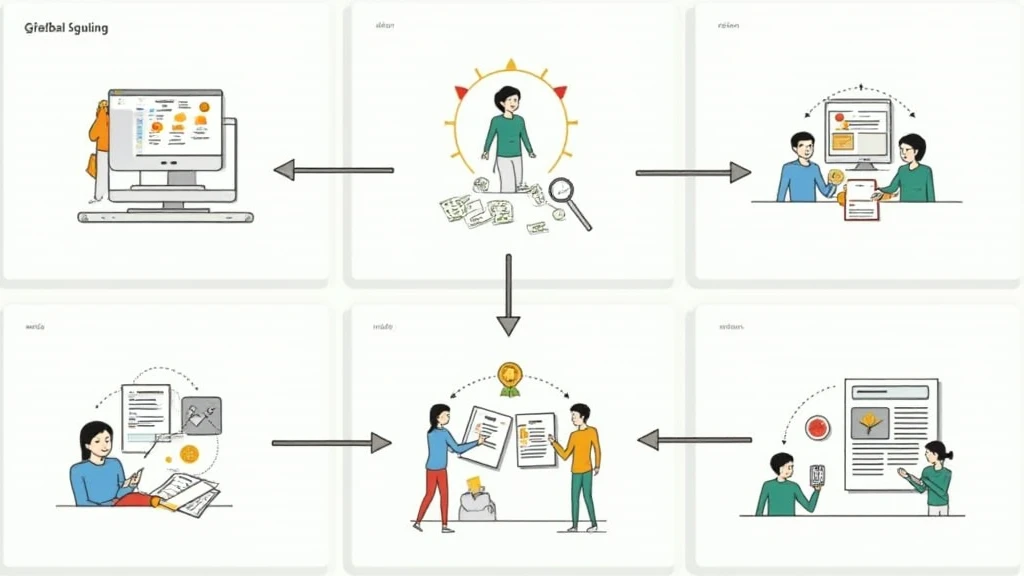

Instruments for Compliance: What You Need

To report your taxes effectively, you will need several tools and methods to keep track of your transactions:

- Transaction records: Maintain a detailed ledger of all crypto transactions.

- Tax software: Consider using software designed for crypto tax reporting for easier calculations.

- Professional advice: Consulting with a tax professional familiar with cryptocurrency regulations could save you time and money.

Navigating Vietnam’s Tax Framework for Crypto

The Vietnamese government released a comprehensive legal framework around cryptocurrency transactions, and staying updated is essential. In 2025, new guidelines are set to expand on compliance expectations:

- Registration for tax purposes: All crypto entities must register with tax authorities.

- Documentation requirements: You may need to submit proof of transaction records.

- Potential penalties for non-compliance: Failure to comply can lead to fines or more severe repercussions.

Strategies for Effective Tax Reporting

Think of it as a puzzle; each strategy you employ helps you fit the pieces together to form a complete picture:

1. Stay Informed

Tax regulations are evolving. Following updates from official government sources or reputable news channels will keep you informed about any changes in the law.

2. Utilize Crypto Tax Software

Many platforms provide tools tailored for crypto users. Services like CoinTracking and Koinly can help you automate the process of transaction tracking and tax calculations.

3. Engage with a Tax Consultant

A financial advisor who specializes in cryptocurrency taxation can provide valuable advice catered to your specific situation, making compliance less daunting.

4. Document Everything

Effective record-keeping is the foundation of transparent tax reporting; ensure that all transaction details are thorough and accurately logged.

The Future of Crypto Taxation in Vietnam

As we gear up for 2025, understanding that the crypto landscape is changing is crucial. Experts project an increase in regulatory scrutiny, which could impact users significantly. If you’re searching for opportunities, here’s a long-tail keyword worth exploring: 2025年最具潜力的山寨币.

The increase in the user base for crypto platforms indicates that more people will need guidance. Therefore, an understanding of how to audit smart contracts is also becoming more relevant in discussions among crypto investors.

Conclusion

Understanding Vietnam crypto tax reporting is not merely about compliance; it’s about securing your financial future amidst the volatile world of digital currencies. Staying updated and well-prepared can be the difference between financial success and setbacks.

By leveraging tools, professional guidance, and staying informed, you can navigate these waters with confidence. Remember, regulatory landscapes evolve, and being proactive is your best defense.

For more insights into cryptocurrency, including the latest regulations and opportunities, visit techcryptodigest.