Vietnam Cryptocurrency Tax Calculation Software: Navigating Compliance for Digital Assets

Introduction

With an estimated $1 billion in cryptocurrency transactions occurring within Vietnam’s burgeoning market, understanding Vietnam cryptocurrency tax calculation software is essential for savvy traders and investors. According to a recent market analysis, approximately 30% of the population is exploring or investing in cryptocurrencies, making it a significant financial frontier. Yet, the challenge lies in navigating local tax compliance. This article delves into the significance of cryptocurrency tax calculation software and how it can enhance compliance and ease your trading experience.

The Necessity of Cryptocurrency Tax Compliance in Vietnam

As Vietnam embraces digital currencies, regulatory bodies have begun emphasizing the need for transparent tax practices. According to the Vietnam Ministry of Finance, laws concerning tax reporting on cryptocurrency transactions are in development. However, current frameworks require all crypto profits to be declared.

- Taxation applies to capital gains from crypto trading.

- Income generated from crypto-related activities is subject to income tax.

- Regulations may vary based on transaction sizes.

Implementing a robust tax calculation system ensures that assets are accurately reported, reducing the risk of audits or penalties.

What is Vietnam Cryptocurrency Tax Calculation Software?

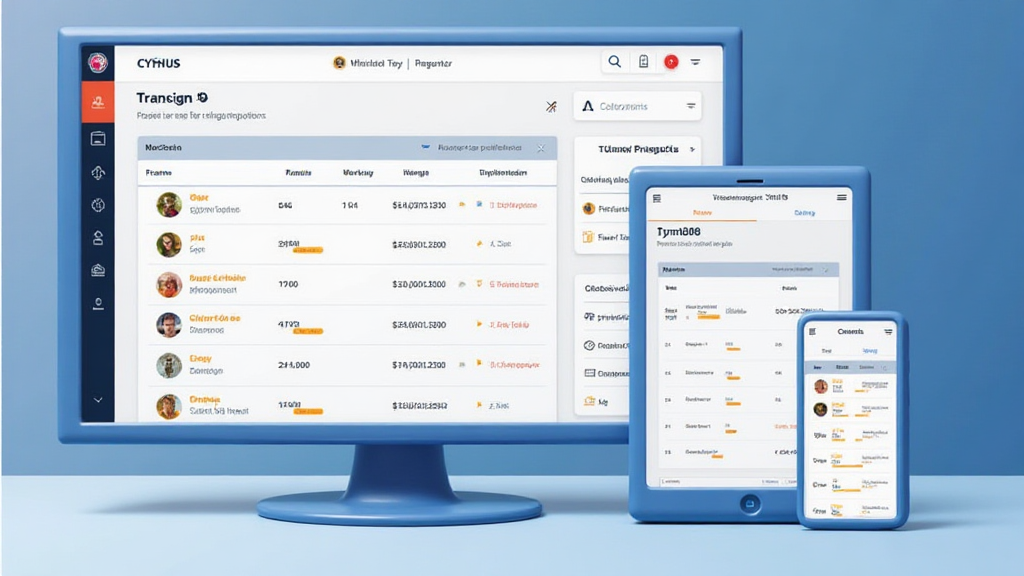

Vietnam cryptocurrency tax calculation software serves as an automated platform designed to monitor, calculate, and report your cryptocurrency trading activities. Here’s the catch: understanding how these tools can benefit users is crucial as the regulations tighten.

- Tracks all transactions and gains in real-time.

- Generates comprehensive tax reports compliant with local laws.

- Integrates easily with wallets and exchange accounts.

This software fuels compliance by providing your financial documentation accurately and on time, per Vietnamese laws.

Key Features of Effective Tax Software

An effective Vietnam cryptocurrency tax calculation software will typically possess several essential features:

- Multi-Exchange Integration: Seamlessly connect with multiple exchanges for a complete overview.

- Real-time Calculation: Instant updates on profit and loss based on current market values.

- User-Friendly Interface: Makes navigation and report generation simple.

- Audit Protection: Keeps logs and documentation to shield against audits.

Platforms like these can save users time and prevent costly mistakes caused by non-compliance.

Understanding the Vietnamese Cryptocurrency Landscape

The cryptocurrency environment in Vietnam is one of rapid growth. Recent studies indicate that Vietnam ranked second in Global Cryptocurrency Adoption, trailing only behind the Philippines. The increasing user growth rate amongst Vietnamese cryptocurrency investors reflects a larger trend in Southeast Asia.

- Over 5 million active cryptocurrency wallets were reported in 2023.

- Government support for blockchain initiatives is expected to rise, indicating a positive future for digital assets.

Investors must stay informed about potential changes to regulations, as evolving laws will influence tax responsibilities.

Case Study: Using Tax Calculation Software Effectively

Consider a local investor, Tran, who actively trades various cryptocurrencies including Bitcoin and Ethereum. Through the use of a specialized tax calculation software, Tran was able to:

- Accurately track the purchase and sale of his assets.

- Calculate his capital gains and losses automatically.

- File his tax returns confidently without the fear of errors.

This streamlined approach not only saved Tran time but also ensured he was 100% compliant with local tax laws.

How to Choose the Right Tax Calculation Software

Selecting the right software can be daunting. Here are some tips for choosing the best Vietnam cryptocurrency tax calculation software for your needs:

- Look for user reviews and testimonials to gauge reliability.

- Ensure it complies with local tax regulations and files the correct forms.

- Evaluate the customer support options – a helping hand can make a big difference.

- Remember the importance of data security; look for encryption features.

A comparison table could further illustrate how different platforms measure up against these criteria.

Conclusion

Navigating the complexities of cryptocurrency tax compliance in Vietnam is significantly simplified through the use of dedicated tax calculation software. As digital assets grow increasingly popular, having the tools to accurately document taxes is essential. This ensures compliance with regulations and minimizes risks against audits. By utilizing the functionalities of efficient software solutions, individuals can not only focus on trading but can also maintain peace of mind regarding their tax obligations.

As you venture into the world of cryptocurrency, remember to prioritize compliance and make the informed decision to employ specialized tools that simplify tax management. For those looking for expert guidance, consider leveraging resources from techcryptodigest.

***Author: Dr. Nguyen Hoang Minh, a blockchain expert with over 10 published papers in the field of financial technology and a leader in various high-profile audits of crypto projects.***