CBDC Implications Global: A New Era for Finance

CBDC Implications Global: A New Era for Finance

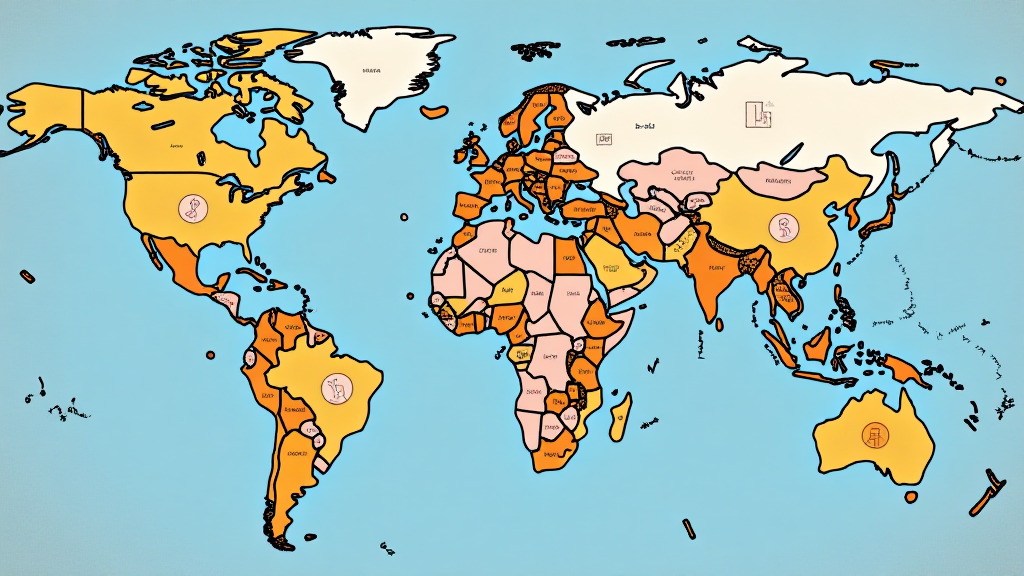

With Central Bank Digital Currencies (CBDCs) emerging as a transformative force in the financial system, experts are predicting significant shifts in how we perceive money and banking. According to a recent report, over 40% of central banks are actively researching CBDCs, signifying the growing trend towards digital currencies. But what does this mean for the global economy, privacy, and individual sovereignty?

Understanding CBDCs: What Are They?

Central Bank Digital Currencies represent digital forms of a country’s sovereign currency, backed and issued by a nation’s central bank. Unlike cryptocurrencies, which are decentralized and operate on public blockchains, CBDCs provide governments with a way to maintain control in the evolving digital landscape.

- Design Variations: CBDCs can be account-based or token-based, offering flexibility in how they are implemented.

- Examples: Countries like China with its Digital Yuan and Sweden with its e-krona are leading the charge.

- Potential Benefits: Enhanced transaction efficiency, lower costs, and increased financial inclusion.

The Global Implications of CBDCs

Implementing CBDCs has numerous implications that can affect economies on a global scale. Here are some key areas impacted:

1. Financial Stability

CBDCs can significantly alter the financial landscape, impacting everything from monetary policy to the stability of banking systems.

- Digital Banking Transformation: Traditional banks may face increased pressure as consumers opt for CBDCs over traditional deposits.

- Global Competitive Dynamics: Countries adopting CBDCs early may gain competitive advantages in international trade and cross-border transactions.

2. Privacy and Surveillance

With CBDCs, a level of state oversight becomes possible that has not existed before.

- Increased Monitoring: Governments may have the capacity to monitor transactions, leading to potential concerns regarding privacy.

- Balancing Act: The need for privacy versus the state’s interest in preventing illicit activities will be a critical discussion point.

3. Cross-Border Transactions

CBDCs can revolutionize the way international transactions are conducted.

- Reduced Costs: The elimination of intermediaries can reduce transaction costs and processing times.

- Currency Stability: A stable digital currency could lead to a decrease in dependence on volatile cryptocurrencies when conducting global trades.

The Case of Vietnam: Growth and Opportunities

Vietnam stands at a crucial juncture with the adoption of CBDCs. The country’s digital economy is expected to grow, with estimates indicating a projected annual growth rate of 29% by 2025. The Vietnamese government has already initiated discussions around the implementation of its own digital currency, which indicates a willingness to embrace technological advancements in finance.

Market Analysis

- User Adoption: With rising internet penetration, approximately 70% of the Vietnamese population is online, providing a fertile ground for digital currency adoption.

- Investment in Blockchain: The Vietnamese government is pushing for the integration of blockchain technologies, enhancing the appeal of CBDCs.

Conclusion: A New Chapter in Financial Evolution

As central banks worldwide explore the adoption of CBDCs, the implications are vast. CBDCs could redefine the nature of money, how transactions are conducted, and the importance of personal privacy in the digital age. Expect to see significant discussions and policy advancements in this area as global economies adapt to these changes.

For more insights about the evolving financial landscape, you can check out techcryptodigest, your source for the latest trends in cryptocurrency and blockchain technology.

Dr. Peter Nguyen is a recognized author and researcher in the blockchain field, having published over 20 papers on cryptocurrency regulation and technology. He has led audits for various high-profile blockchain projects, ensuring security and compliance.