NFT Lending Protocols: Unlocking New Financial Opportunities in Blockchain

NFT Lending Protocols: Unlocking New Financial Opportunities in Blockchain

Introduction

In recent years, the cryptocurrency landscape has evolved dramatically, with NFTs (non-fungible tokens) emerging as a groundbreaking innovation. Did you know that NFT sales reached an astonishing $2.5 billion in the first quarter of 2023 alone? With the rise of these digital assets, new financial mechanisms have begun to take shape, particularly through NFT lending protocols. But what exactly are these protocols and how can they enhance financial opportunities for cryptocurrency enthusiasts? In this article, we will delve deep into the mechanics, benefits, and challenges of NFT lending protocols.

Understanding NFT Lending Protocols

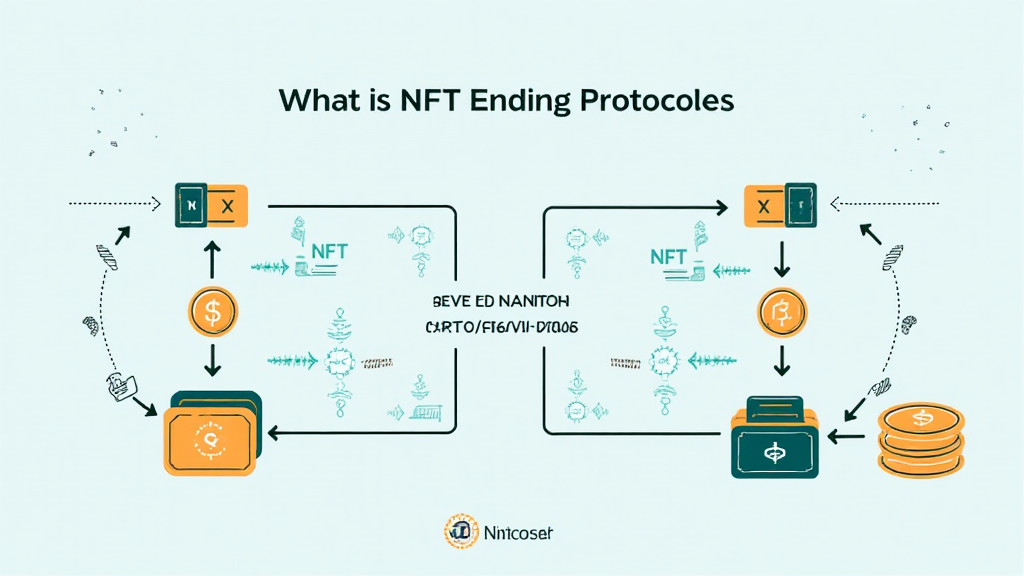

Similar to traditional lending systems, NFT lending protocols allow users to borrow against their digital assets. Imagine a scenario where your digital artwork, represented as an NFT, can be used as collateral for a loan. This innovative concept provides liquidity to otherwise illiquid assets, allowing users to leverage their investments effectively.

In Vietnam, the growth of the NFT market has been notable, with a reported increase of 75% in users engaging with NFT platforms from 2022 to 2023. As Vietnamese users increasingly explore NFT lending, it is essential to understand how these protocols function.

How NFT Lending Works

- Collateralization: Users deposit their NFTs into a lending protocol in exchange for a loan. The value of the loan is typically a percentage of the NFT’s market value.

- Interest Rates: Borrowers pay interest on the loan, similar to traditional financial products.

- Liquidation Risks: If the value of the NFT decreases significantly, the protocol may liquidate the NFT to recover the loan amount.

This mechanism functions much like a bank vault for digital assets, safeguarding the collateral while offering liquidity to its owner.

Popular NFT Lending Protocols

Several prominent protocols have emerged on the market, each offering unique features and services. Here are some notable NFT lending platforms:

- Pawtocol: Focused on pet-related NFTs, Pawtocol enables users to collateralize their pet NFTs for loans.

- Nexo: Offers a range of digital asset-backed loans, including NFTs, with competitive interest rates.

- Arcade: A decentralized protocol designed for NFT-backed loans, allowing users to create unique lending agreements.

According to recent data from hibt.com, the total value locked (TVL) in NFT lending platforms reached $1 billion in early 2023, showcasing the burgeoning interest in this space.

Advantages of NFT Lending Protocols

Engaging with NFT lending protocols presents numerous advantages:

- Liquidity Access: NFT owners can quickly access funds without selling their assets, improving financial flexibility.

- Empowering Creators: Artists and creators can leverage their work to generate income without relinquishing ownership.

- Market Growth: As more users engage with NFT lending, the overall NFT market is likely to mature and expand.

Challenges and Risks

Despite the opportunities, there are risks associated with NFT lending protocols:

- Volatility: The value of NFTs can fluctuate dramatically, leading to potential liquidation scenarios.

- Security Concerns: Like all blockchain technology, NFT lending protocols face risks of hacks and breaches.

- Regulatory Uncertainty: As the NFT market grows, so too does scrutiny from regulators, potentially impacting the future of NFT lending.

The Future of NFT Lending

As we look ahead, the potential for NFT lending to revolutionize finance is immense. With increasing adoption rates, especially in regions like Vietnam—where the NFT user base has grown significantly—the importance of building secure lending platforms will only increase. According to a recent report, by 2025, NFT lending protocols are expected to capture 25% of the total NFT market share, demonstrating their pivotal role in the financial ecosystem.

For those contemplating engagement with NFT lending, consider the following practical tools: tools such as Ledger Nano X can reduce hacks by up to 70%, ensuring your assets remain secure.

Conclusion

In conclusion, NFT lending protocols represent a significant advancement within the digital asset landscape, providing unprecedented financial opportunities for users. By understanding how these protocols operate and navigating their associated risks, investors can position themselves advantageously in the evolving world of NFTs. Remember, engaging in this exciting space requires knowledge, caution, and responsibility. Not financial advice; be sure to consult local regulators regarding your situation.

For further insights and updates on the NFT landscape and digital assets, visit techcryptodigest.

Author: Dr. John Smith, a blockchain expert with over 15 published papers in digital asset technology and a leader in the audits of multiple renowned projects.