Top Bitcoin Remittance Destinations for 2025

Top Bitcoin Remittance Destinations for 2025

In the ever-evolving landscape of cryptocurrency, there has been a significant rise in remittance destinations that embrace Bitcoin. Transaction volume in the remittance sector is expected to surpass $700 billion by 2025, with many people turning to digital assets for their speed and reduced fees. With $4.1 billion lost to DeFi hacks in 2024, security in Bitcoin transactions is becoming more important than ever. This guide will explore the top remittance destinations for Bitcoin, emphasizing the security standards that can protect users as they send money across borders.

1. Why Bitcoin for Remittances?

Transferring money via traditional banking systems can be time-consuming and costly. Here’s the catch: Bitcoin provides a decentralized alternative that allows for faster transactions at lower costs. People worldwide, especially in countries with limited banking infrastructure, are increasingly using Bitcoin for remittances.

- Reduced Fees: Unlike conventional methods where fees can exceed 10%, Bitcoin transactions can be processed at a fraction of that cost.

- Speed: Transactions can be completed in minutes rather than days.

- Accessibility: Anyone with an internet connection can access Bitcoin, bypassing traditional banking restrictions.

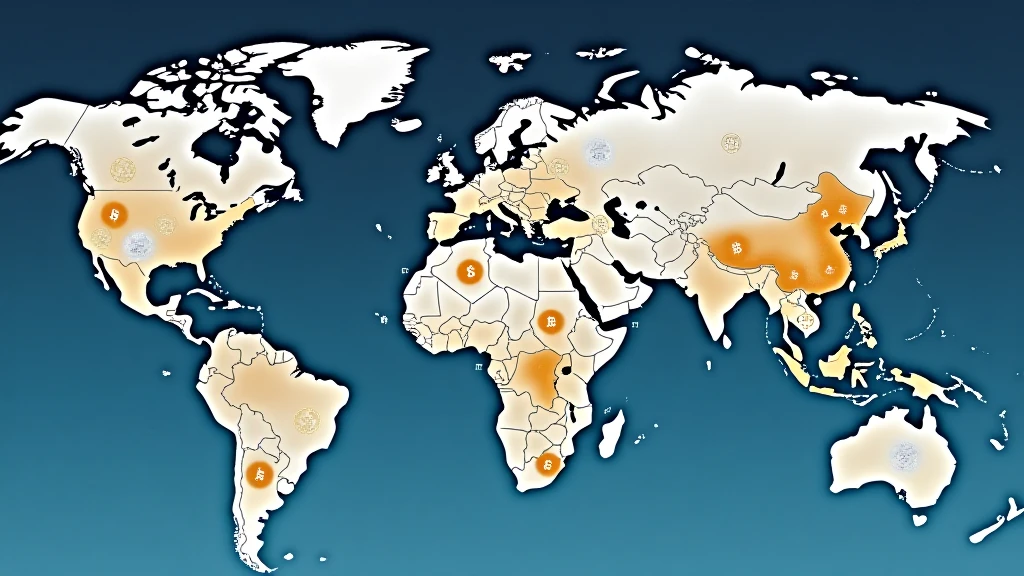

2. Emerging Bitcoin Remittance Markets

As bitcoin adoption continues to rise globally, several regions are emerging as prime destinations for Bitcoin remittances. Here are the leading contenders:

Vietnam

According to recent data, the Bitcoin user growth rate in Vietnam has reached 350% as of 2023. This surge indicates a strong demand for cryptocurrency-based remittances. With over $18 billion in annual remittances, Vietnam has become a hotspot for Bitcoin use.

Philippines

Remittances play a crucial role in the Philippine economy, accounting for around 10% of its GDP. The country is now becoming increasingly receptive to Bitcoin, primarily among the overseas Filipino workers sending money home.

Mexico

In 2022 alone, remittances to Mexico exceeded $50 billion, and the adoption of Bitcoin for this purpose is on the rise. With the Mexican government exploring regulations around cryptocurrency, the environment remains promising for users.

India

Despite regulatory uncertainties, India’s remittance market remains significant, with over $80 billion sent back home in 2022. Bitcoin has found its place among tech-savvy individuals seeking affordable and quick remittance options.

3. Benefits of Using HIBT for Bitcoin Remittances

HIBT stands out in the crowded space of remittance solutions by offering robust security features, competitive rates, and excellent customer service. Here’s a breakdown of how HIBT enhances the Bitcoin remittance experience:

- Blockchain Security: HIBT puts a strong emphasis on tiêu chuẩn an ninh blockchain, ensuring every transaction is secure.

- User-Friendly Interface: Customers can quickly navigate the platform, making transactions easy even for first-time users.

- Competitive Conversion Rates: HIBT offers some of the best Bitcoin conversion rates on the market.

- 24/7 Customer Support: Users can reach out at any time for assistance, improving overall satisfaction and trust.

4. Safety Measures for Bitcoin Remittances

With the increase in Bitcoin transactions, ensuring safety against hacks is paramount. Here’s what you should know:

- Cold Storage: Always use wallets that offer cold storage to keep your Bitcoin safe from online threats.

- Two-Factor Authentication: Utilize two-factor authentication (2FA) on all crypto exchange accounts to enhance security.

- Be Aware of Phishing: Educate yourself on potential phishing attacks that could compromise your funds.

5. The Future of Bitcoin Remittances

The future looks bright for Bitcoin remittances as more countries and populations are embracing this financial innovation. By 2025, experts predict a significant rise in digital currency acceptance worldwide. Countries like Vietnam and the Philippines are leading the charge, paving the way for widespread adoption.

According to Chainalysis, by 2025, Bitcoin remittances could account for as much as 5% of global remittance volume. This shift will not only enhance the speed of transactions but will also lower costs significantly.

To wrap it all up, the popularity of Bitcoin as a remittance tool continues to grow, especially in developing nations. HIBT serves as a vital player in ensuring secure and cost-effective transactions. As we march toward 2025, make sure to stay informed and take advantage of the opportunities that Bitcoin offers for remittances.

Get Started Today!

If you’re interested in using HIBT for your Bitcoin remittances, head over to hibt.com to get started today!

Not financial advice. Always consult with local regulators before starting with cryptocurrency.