HIBT Bitcoin Market Sentiment Analysis: Understanding Market Trends

HIBT Bitcoin Market Sentiment Analysis: Understanding Market Trends

As we step into 2025, the cryptocurrency landscape presents an intriguing mix of challenges and opportunities. With over $4.1 billion lost to DeFi hacks in 2024 alone, it’s crucial for investors and stakeholders to grasp the changing sentiment towards Bitcoin and other cryptocurrencies.

In this article, we will delve into the HIBT Bitcoin market sentiment analysis, exploring what influences market movements, how traders can interpret these sentiments, and the implications for future investments. Alongside this, we’ll examine the growing interest in the Vietnamese market, which has seen a staggering increase in cryptocurrency participation over recent years.

What is Market Sentiment Analysis?

Market sentiment analysis involves understanding the overall attitude of investors towards specific assets or the market as a whole. In the cryptocurrency sector, this analysis can help identify whether traders are feeling bullish (optimistic) or bearish (pessimistic) about Bitcoin’s price movements.

- Sentiment Indicators: These are tools used to gauge investor emotions, such as trading volume, price trends, and social media chatter.

- Market Trends: Sentiment analyses often reveal patterns that can indicate future price movements, providing traders with vital insights.

The Role of Social Media in Bitcoin Sentiment

Social media platforms have become a significant source of market sentiment data. Platforms like Twitter, Reddit, and specialized cryptocurrency forums contribute substantially to the public discourse surrounding Bitcoin.

For instance, a surge in positive tweets or Reddit posts about Bitcoin can indicate a bullish sentiment, while negative press can have the opposite effect. In Vietnam, where social media engagement around cryptocurrencies is particularly high, sentiment plays a crucial role in shaping investor behavior.

Case Study: Vietnam’s Growing Crypto Community

Vietnam has positioned itself as a rapidly growing hub for cryptocurrency adoption, driven by youthful demographics and increasing technological infrastructure. According to the latest data, approximately 24% of Vietnamese internet users are involved in cryptocurrency, a figure that continues to rise.

This enthusiasm is reflected in the social media discourse, where Vietnamese investors often discuss Bitcoin trends, share insights, and express their sentiments towards market movements.

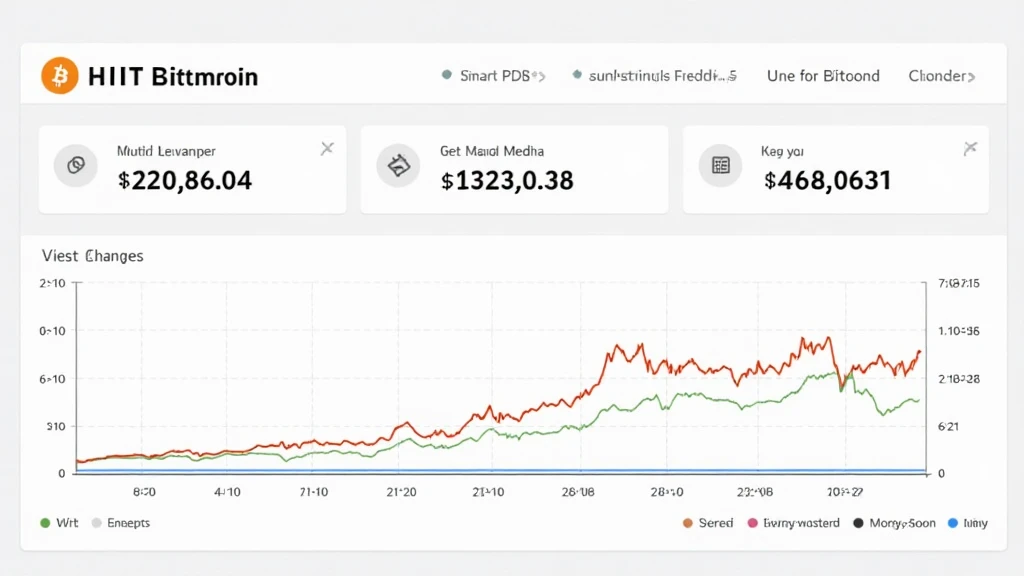

Analyzing the HIBT Bitcoin Market Sentiment Index

HIBT’s Bitcoin Market Sentiment Index employs a combination of social media analytics, price data, and trading volume metrics to provide a comprehensive view of market sentiment.

The index features:

- Social Media Sentiment Score: This score aggregates sentiments from various platforms, giving a clear view of public opinion regarding Bitcoin.

- Price Action Analysis: Incorporating technical analysis of Bitcoin price trends over specific periods helps identify potential reversal points.

- Trading Volume Tracking: Sudden spikes in trading volume often correlate with shifts in market sentiment, indicating trader psychology.

Using HIBT Sentiment Tools for Trading Decisions

Traders can leverage the HIBT sentiment tools to make informed decisions:

- Identifying Trend Reversals: By analyzing the sentiment index, traders can spot changes in market trends, potentially enabling profitable strategies.

- Understanding Market Psychology: Gaining insights into the collective psyche of Bitcoin traders can help assess the risks associated with market movements.

For instance, if the sentiment shifts from bullish to bearish with increased trading volume, it may signal a good time to reassess positions.

Future Outlook: What Lies Ahead for Bitcoin?

As the crypto market evolves, the role of sentiment analysis in trading practices will likely become even more pronounced. The HIBT Bitcoin market sentiment analysis can aid investors in navigating market volatility effectively.

Looking ahead to 2025, several factors may influence market sentiment:

- Regulatory Changes: Global regulatory developments surrounding cryptocurrencies can drastically change market sentiment.

- Technological Advancements: Innovations in blockchain technology, including enhancements in scalability and security, can positively impact Bitcoin’s adoption rate.

- Investors’ Education: Increasingly knowledgeable investors will likely read the market more effectively, leading to more stable price actions.

Conclusion

In summary, HIBT Bitcoin market sentiment analysis is an invaluable tool for anyone looking to operate successfully in the cryptocurrency market. By understanding the emotions driving the market and examining social media sentiment, traders can make more informed decisions.

With Vietnam’s rapid growth in cryptocurrency adoption, staying updated on local market sentiments can provide significant advantages. As we head towards 2025, the ability to interpret market sentiment will not just refine trading strategies but also improve overall market understanding.

Keep learning and adapting as the crypto landscape continues to shift. It’s crucial to engage with reliable sources like HIBT for the latest updates and analyses. Remember, not all investment advice is universal. Always consult with local regulatory bodies before investing in digital assets.

Author: Dr. Nguyen Tran, a distinguished financial analyst with over 15 published papers in cryptocurrency research. Dr. Tran has led audits for several prominent blockchain projects and continues to educate investors about market dynamics.