Understanding HIBT Crypto Market Liquidity Ratios: A Comprehensive Insight

Understanding HIBT Crypto Market Liquidity Ratios: A Comprehensive Insight

With billions lost in the volatile crypto landscape, understanding liquidity ratios is crucial. In 2024, the crypto market experienced a staggering $4.1 billion loss due to hacks and market manipulation. As we step into 2025, it becomes increasingly important for investors to grasp the significance of liquidity in the crypto market. That’s where HIBT crypto market liquidity ratios come into play, offering clarity and strategic advantage.

What are Liquidity Ratios?

Liquidity ratios measure how easily an asset can be converted to cash without affecting its market price. For cryptocurrency, these ratios assess how well a particular token can be traded on the market without causing large price swings.

Here’s a quick breakdown of liquidity ratios:

- Current Ratio: Compares current assets to current liabilities.

- Quick Ratio: Similar to the current ratio but excludes inventory.

- Cash Ratio: Measures liquidity by comparing cash and cash equivalents to current liabilities.

Why Liquidity Matters in Crypto

Understanding liquidity is vital for any investor, especially in a market known for its price volatility. High liquidity means an asset can be easily bought or sold without causing drastic price changes.

A prevalent analogy is thinking of liquidity like water in a pool. A full pool (high liquidity) allows for smooth swimming (trading), while a nearly empty pool (low liquidity) makes movement difficult, often leading to unwanted splashes (price swings).

Introducing HIBT and Its Liquidity Ratios

The HIBT platform has been gaining traction due to its transparency and user-friendly interface. As one of the promising players in the market, it has developed unique liquidity ratios that provide deeper insights into crypto assets.

Key Features of HIBT Liquidity Ratios

- Real-time Tracking: Instant access to liquidity metrics enhances decision-making.

- Comparison Tools: Compare liquidity ratios with competitors effortlessly.

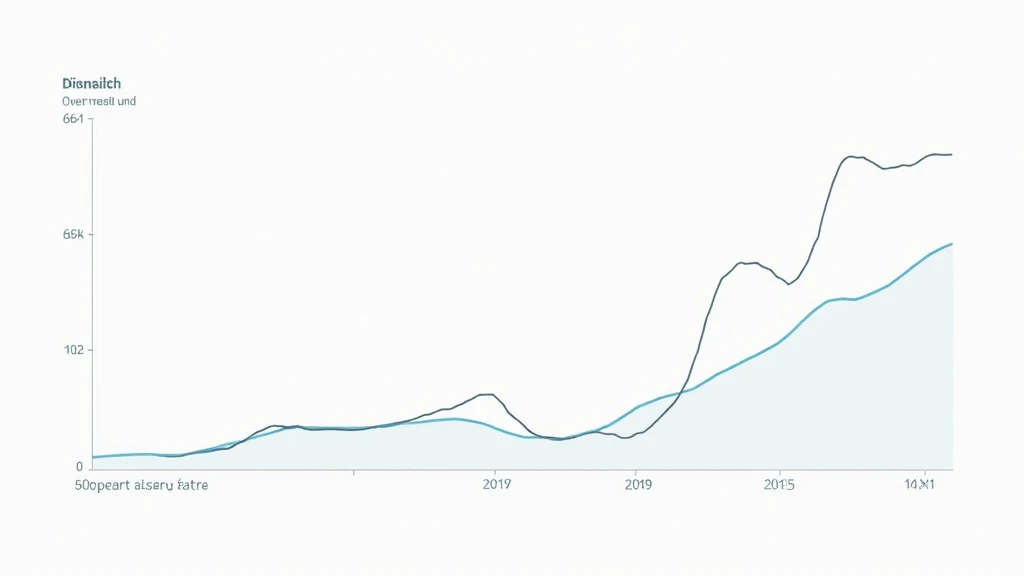

- Historical Data: Analyze past liquidity trends for better predictions.

How to Use HIBT Liquidity Ratios for Investment Decisions

Investors can leverage HIBT liquidity ratios to gauge the health of a crypto asset. For instance, a high liquidity ratio can signify a safer investment, while low ratios may indicate potential risk.

Vietnam’s Expanding Crypto Market

As investors explore new opportunities, Southeast Asia is emerging as a key player in the crypto landscape. Notably, in Vietnam, there has been a 120% increase in crypto users within the last year. This trend may impact liquidity ratios significantly as more users enter the market.

Liquidity Ratios in the Context of Vietnam

Considering the rapid growth of crypto users, understanding local liquidity ratios becomes especially pertinent. Local exchanges have adapted their models to enhance liquidity due to increasing demand.

Analyzing 2025 Trends for Crypto Liquidity Ratios

As we anticipate 2025, predictive analysis indicates a shift in liquidity models, likely influenced by regulatory frameworks and technological advancements.

Pending Regulations and Their Impact

A key factor affecting liquidity ratios will be new regulations aimed at ensuring market trust and security. According to Chainalysis, approximately 70% of projected crypto investors in 2025 are likely to prioritize platforms with strong regulatory compliance and proven liquidity.

Conclusion

As we navigate the complexities of the crypto landscape, HIBT’s liquidity ratios will be integral in guiding investments and mitigating risks. For investors, understanding these metrics empowers them to make informed decisions and seize market opportunities.

In summary, liquidity ratios are not mere numbers; they reflect the very pulse of the crypto market. As we move into the future, utilizing tools like HIBT can greatly enhance your investment strategy.

For more information on crypto-related insights and resources, visit hibt.com.

Author: Dr. Alex Thompson, a blockchain researcher and author of over 25 papers, has played a pivotal role in auditing renowned blockchain projects.