Bitcoin Halving Market Forecasts: What to Expect in 2025

Bitcoin Halving Market Forecasts: What to Expect in 2025

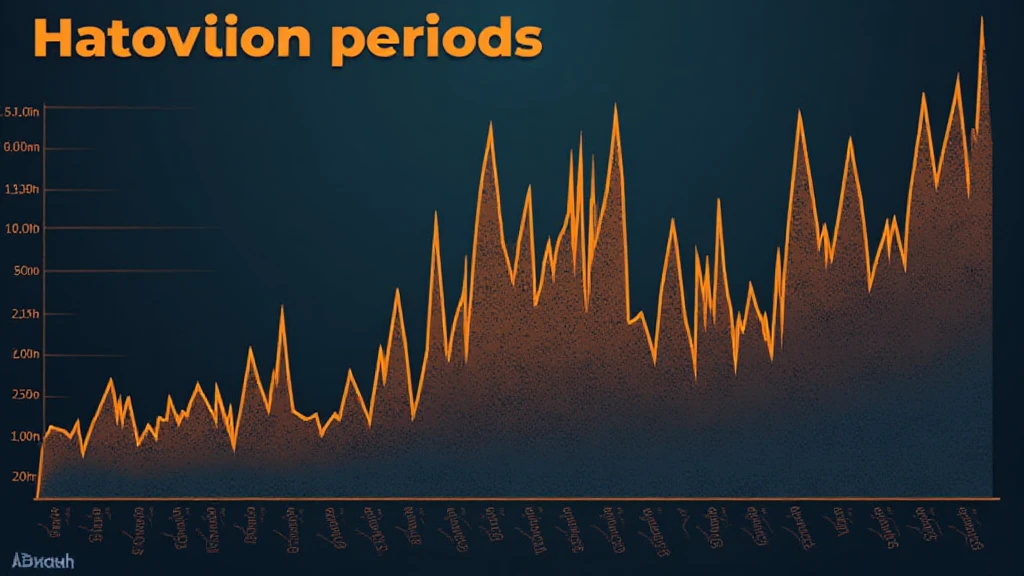

With a staggering $4.1 billion lost to DeFi hacks in 2024, the importance of understanding market trends becomes ever more crucial for investors in cryptocurrencies. As Bitcoin approaches its next halving event, many are left wondering: what will this mean for the market? Let’s break down everything you need to know about Bitcoin halving, its implications on the market, and forecasts leading up to 2025.

Understanding Bitcoin Halving

Bitcoin halving is an event that occurs approximately every four years, reducing the reward for mining Bitcoin by half. This mechanism is built into the Bitcoin protocol to control inflation and create scarcity. The last halving took place in May 2020, when the block reward decreased from 12.5 BTC to 6.25 BTC. The upcoming halving, expected in 2024, will reduce the reward to 3.125 BTC.

The Economic Mechanism Behind Halving

- Supply and Demand: As the supply of new Bitcoins decreases, the economic model suggests that if demand remains constant or increases, the price will likely go up.

- Past Performance: Historically, Bitcoin has experienced significant price increases following halving events. For example, after the 2016 halving, the price shot up from around $650 to over $20,000 in late 2017.

- Investor Sentiment: Halving events often lead to speculation and excitement within the crypto community, which can further drive demand.

Market Sentiment Leading Up to the 2024 Halving

As we approach the next halving in 2024, market sentiment plays a pivotal role. Data shows that Vietnam is seeing a significant increase in crypto adoption, with user growth rates exceeding 40% in the last year alone. This reflects a global trend of increasing interest in cryptocurrencies as investment vehicles.

Key Indicators to Watch

- Trading Volume: Monitoring Bitcoin’s trading volume can provide insight into investor interest and potential price movements.

- Market Cap Changes: A rising market cap can indicate a growing trust in Bitcoin leading up to the halving.

- SOCIAL MEDIA trends: Monitoring social media sentiment can also offer clues. Positive discussions often lead to increased buying pressure.

Price Forecasts Post-Halving

Forecasting Bitcoin’s price post-halving involves several factors, including historical trends and current market conditions. In 2025, experts foresee a dramatic shift:

- 2025 Price Predictions: Many analysts believe that Bitcoin could reach $100,000 to $250,000 depending on various market conditions and adoption rates.

- Potential Market Cap: A market cap of over $4 trillion is not out of reach for Bitcoin if these projections come to fruition.

- Adoption Rates: If current trends in regions like Vietnam continue, widespread adoption could fuel more rapid price increases.

Impact of Regulations on Bitcoin Price

As Bitcoin continues to mature, regulatory changes are inevitable. Countries are ramping up their regulatory frameworks:

Vietnam’s new crypto tax laws could shape trading behavior and market stability further impacting Bitcoin’s price dynamics.

Key Regulations to Follow

- Tax Implications: Stay informed about tax regulations in your region, as these can significantly impact investor behavior.

- Compliance Standards: The rise of compliance standards, such as tiêu chuẩn an ninh blockchain, will influence how institutional investors engage with Bitcoin.

- Government Adoption: Government adoption of Bitcoin could lead to massive price surges, similar to trends seen in countries like El Salvador.

The Future of Bitcoin and Beyond

What lies ahead after the 2024 Bitcoin halving? The prospects may hinge on new technological advancements, market expansions, and global economic conditions.

Technological Innovations

- Layer 2 Solutions: Advances such as the Lightning Network are expected to enhance Bitcoin’s scalability.

- Smart Contracts: Innovations that allow for smart contracts on Bitcoin can pave the way for decentralized finance.