Vietnam KYC Procedures: A Comprehensive Guide for Cryptocurrency Platforms

Vietnam KYC Procedures: A Comprehensive Guide for Cryptocurrency Platforms

With the recent rise of cryptocurrency adoption in Vietnam, safeguarding user identities through proper KYC (Know Your Customer) procedures has become more crucial than ever. Vietnam’s cryptocurrency market has experienced an explosive growth rate, attracting millions of users and numerous platforms. However, with great opportunities come significant risks—such as the increasing potential for fraud and money laundering. Therefore, understanding Vietnam KYC procedures is paramount for crypto platforms aiming to establish a trustworthy environment.

The Importance of KYC in Cryptocurrency

KYC procedures serve as a gatekeeper in the financial world, ensuring that services are only provided to legitimate customers. In the realm of cryptocurrency, this is even more important due to its decentralized and often anonymous nature. According to Hibt.com, the Vietnamese crypto market is projected to grow by 30% annually over the next five years, making KYC compliance crucial for platforms looking to thrive.

What Exactly Is KYC?

- KYC Defined: KYC is a process used by financial institutions to verify the identities of their clients, ensuring that they are not involved in illicit activities.

- Key Components: KYC typically involves collecting documents like government-issued ID, proof of address, and sometimes biometric data.

- Legal Requirements: KYC compliance is mandated by local laws and regulations, creating a necessary framework for operation.

Vietnam’s KYC Regulations: An Overview

In Vietnam, various laws govern KYC procedures. The most significant is the Law on Anti-Money Laundering enacted in 2012 and updated subsequently. This law mandates that financial institutions, including cryptocurrency platforms, implement KYC measures to identify risks and protect against criminal activities.

Key Aspects of Vietnamese KYC Procedures

- Customer Identification: Platforms are required to identify their customers comprehensively to reduce the risk of fraud.

- Risk Assessment: KYC must include evaluating the risk profile of the customer based on their transaction behaviors.

- Monitoring Activities: Continuous monitoring of customer transactions is essential to detect suspicious activities.

- Document Retention: All KYC documentation must be retained for a specific period to comply with regulatory audits.

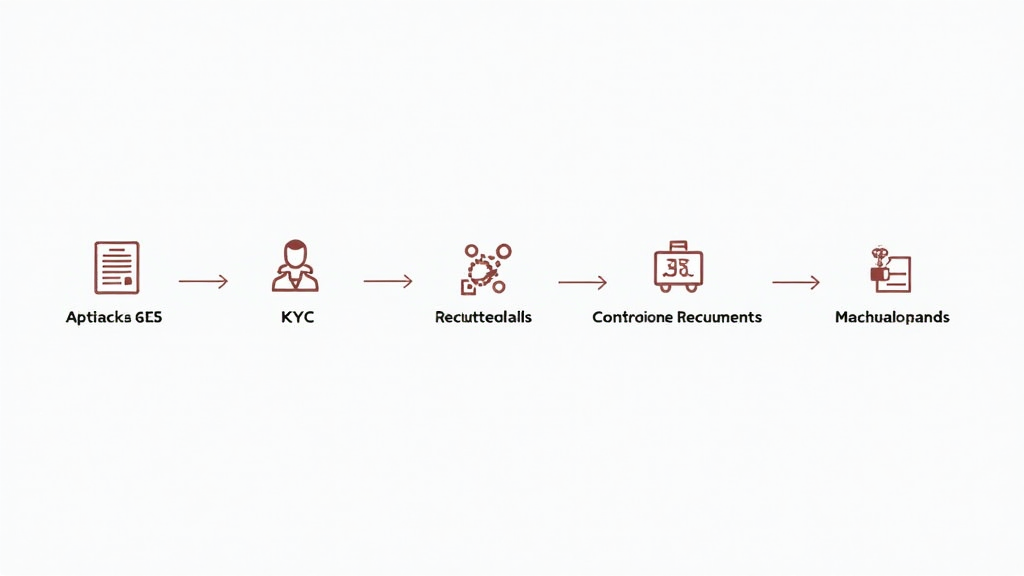

Steps to Implement Effective KYC in Vietnam

Implementing KYC procedures effectively does not need to be cumbersome. Here’s how platforms can streamline the process:

1. Design a Clear KYC Policy

Having a clear KYC policy is essential. This involves clearly defining customer identification and verification processes that comply with local regulations.

2. Utilize Technology for Verification

Modern tools such as facial recognition software, artificial intelligence verification systems, and blockchain technology can drastically improve the accuracy and efficiency of KYC procedures.

3. Train Staff Regularly

Regular training sessions should be conducted for staff members responsible for KYC verification to keep them informed about the latest regulations and technologies.

4. Audit and Update KYC Procedures

Periodically auditing KYC processes ensures that they remain compliant and efficient. It allows platforms to adapt to changes in regulations or market conditions.

Challenges of KYC Procedures in Vietnam

While implementing KYC procedures, platforms face various challenges, including:

1. Technology Integration

Many platforms struggle to integrate advanced technologies necessary for efficient KYC processes, leading to inefficiencies.

2. User Resistance

Some users may be resistant to providing personal information due to privacy concerns, which can hinder the KYC process.

3. Regulatory Complexity

The changing landscape of laws and regulations can create hurdles, making it difficult for platforms to stay compliant.

Conclusion: Building Trust Through KYC

In Vietnam’s rapidly growing cryptocurrency space, rigorous adherence to KYC procedures not only enhances compliance but also boosts user trust. As regulations evolve, platforms must keep adapting to stay ahead of potential risks. By investing in efficient KYC processes, crypto platforms can create a safer environment for users, fostering long-term growth and stability.

In summary, understanding and implementing Vietnam KYC procedures is essential for cryptocurrency platforms. It protects both the platform and its users from risks while ensuring compliance with legal mandates.

For crypto platforms in Vietnam, adherence to these procedures remains critical amidst ongoing regulatory changes. As a growing market, the future of Vietnam’s crypto landscape will be shaped by those who prioritize secure transactions and the implementation of robust KYC practices.

Techcryptodigest is committed to providing insightful information and updates surrounding cryptocurrency regulations, including detailed analyses like this one on Vietnam KYC procedures.

Written by Dr. Nguyen Phuc, a blockchain compliance specialist with over 15 publications in the field and having led audits for prominent projects in Southeast Asia.