Vietnam Crypto Investment Regulations 2025: Navigating the Future

Vietnam Crypto Investment Regulations 2025: Navigating the Future

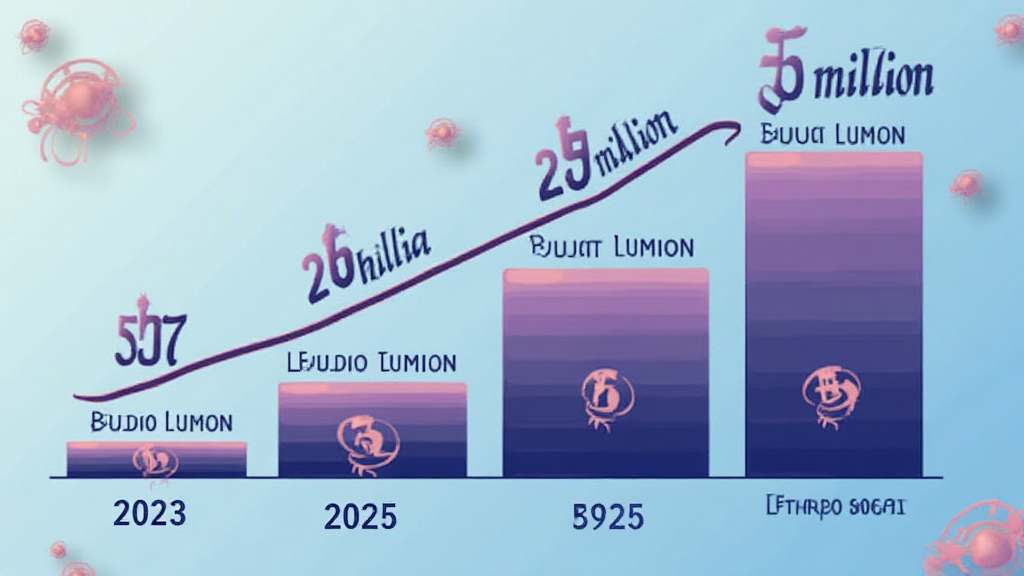

As we move towards 2025, the investment landscape in Vietnam’s crypto market is set to evolve dramatically. With a rapid growth in the number of users—expected to reach over 5 million by 2025—it’s crucial for investors to understand the regulations that govern crypto investments in the country. In 2024, a staggering $4.1 billion was lost to DeFi hacks globally, emphasizing the necessity for robust investment regulations.

Understanding Vietnam’s Regulatory Framework

Vietnam has been actively working on its regulatory framework regarding cryptocurrencies and blockchain technology. As of 2025, the government aims to implement a comprehensive strategy to ensure that investors are adequately protected. The proposed regulations will likely cover various aspects:

- Licensing and registration of crypto exchanges

- Anti-money laundering (AML) protocols

- Consumer protection measures

According to a recent report by the Ministry of Finance, these regulations are expected to create a safer environment for both local and foreign investors, fostering growth in the industry.

Key Components of 2025 Regulations

As these regulations unfold, certain key components are anticipated to play a vital role:

Licensing Requirements

The government will require all crypto exchanges operating within Vietnam to obtain a license. This process is not just a formality; it’s designed to ensure that only trustworthy platforms can facilitate investments. Consider it similar to a bank needing a charter to operate.

Consumer Protection Measures

Another focal point will be consumer protection, which covers aspects such as:

- Transparent communication from crypto platforms

- Clearly defined withdrawal and operational policies

- Insurance for user funds against hacks or fraud

These measures will be crucial for instilling confidence among investors, especially in a landscape fraught with scams and security vulnerabilities.

Impact of Regulations on Investment Strategies

For investors in Vietnam, understanding how these regulations will shape investment strategies is critical. Here’s what to consider:

Taxation Policies

As part of the new regulations, taxation of crypto gains will be formalized, eliminating confusion for investors. It’s anticipated that:

- Local cryptocurrencies will be taxed differently compared to foreign ones

- Clear guidelines on reporting gains will simplify tax obligations

Safety of Smart Contracts

Amidst all these, ensuring the safety of smart contracts will also be a priority. Investors will want to learn how to audit smart contracts to protect their investments. Tools and guidelines are expected to emerge to help mitigate risks associated with decentralized applications.

Market Trends and User Growth in Vietnam

The Vietnamese market has shown incredible potential for cryptocurrency adoption. A notable increase in the user base is evident:

| Year | Estimated Users |

|---|---|

| 2023 | 3 million |

| 2024 | 4 million |

| 2025 | 5 million+ |

Source: Vietnam Digital Economy Report 2024.

Best Practices for Investors in 2025

With new regulations in place, investors should adopt best practices. Here are some suggestions:

- Stay Informed: Regularly check for updates on laws and regulations.

- Use Reputable Platforms: Only engage with licensed exchanges to avoid fraud.

- Educate Yourself: Understand the technology behind your investments, including blockchain security standards and tiêu chuẩn an ninh blockchain.

Conclusion: The Future of Crypto Investment in Vietnam

As Vietnam moves towards a more structured regulatory environment for crypto investments, stakeholders must adapt to these changes. With the anticipated growth in the number of users and the increased focus on security and consumer protection, the landscape is transforming. Investors need to stay proactive and informed to navigate this new environment successfully.

Ultimately, understanding the Vietnam crypto investment regulations in 2025 will empower investors to make informed decisions moving forward. Remember that while these regulations aim to protect, the responsibility also lies with the individual to seek out reputable information and platforms within this emerging market.

For more insights and updated information on crypto regulations and investment strategies in Vietnam, visit hibt.com and read our Vietnam crypto tax guide.

Written by Dr. Nguyen Minh, a blockchain expert with over 15 years of experience in financial technologies. He has published more than 25 papers in this field and has led audits for several high-profile projects globally.