Understanding HIBT Crypto Order Types: A Deep Dive into Trading Strategies

Introduction to HIBT Crypto Order Types

The cryptocurrency trading landscape is evolving rapidly, with millions of users engaging in buying, selling, and trading digital assets. As of 2023, the global cryptocurrency market has seen extraordinary growth, with estimated $4.1 billion lost to hacks in DeFi platforms in 2024. These statistics raise crucial questions for traders and investors alike: How can one navigate the complexities of trading? What order types can enhance your trading strategy?

This article aims to dissect the different HIBT crypto order types and provide insights into how these can optimize trading for users, especially within the booming Vietnamese market, where the user growth rate of cryptocurrency is skyrocketing.

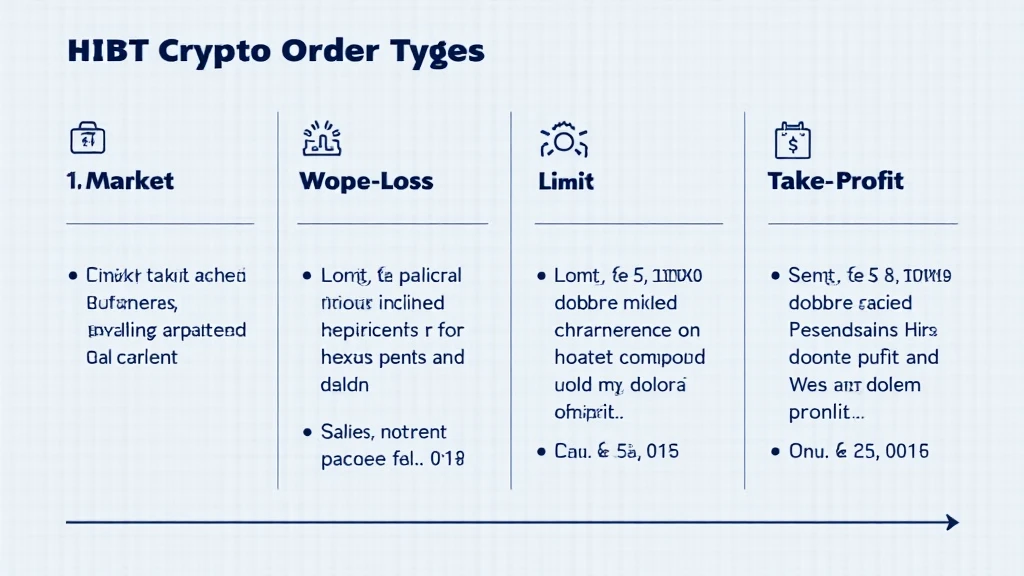

Understanding HIBT Crypto Order Types

In the world of crypto trading, the ability to execute trades effectively is essential for maximizing profits and minimizing losses. Here are the primary HIBT crypto order types utilized by traders:

- Market Orders: Executed immediately at the current market price. Ideal for those looking to trade quickly without delay.

- Limit Orders: Set a specific price at which you want to buy or sell an asset. Useful for those who believe the price will increase or decrease in the future.

- Stop-Loss Orders: Automatically sells your asset when a specified price is reached. This helps mitigate losses in a declining market.

- Stop-Limit Orders: Combines a stop order and a limit order. It triggers a limit order once the stop price is hit, giving you control over the selling price.

- Take-Profit Orders: Automatically sell an asset when it reaches a specified level of profit. Useful for securing gains.

Market Orders Explained

Market orders are the simplest form of order type. It signifies a buy or sell request to be executed at the best available current price. Here’s how it works in real-life trading:

The execution is akin to walking into a store and purchasing an item at the current price without haggling.

Limit Orders in Detail

Limit orders provide traders with a level of control over their trades. By setting a price, you can patiently wait for the market to meet your expectations.

This is like setting a price you’re willing to pay for a product online and waiting for it to drop to that price before buying.

Understanding Stop-Loss and Stop-Limit Orders

These order types are vital for risk management. Traders use stop-loss orders to prevent excessive losses during high volatility.

Think of a stop-loss like a safety net that catches you if you fall, ensuring you don’t lose more than you can afford.

Take-Profit Orders and Their Significance

Similar to stop-loss, take-profit orders help in managing the optimization of profits. When the cryptocurrency reaches your target price, it will automatically sell, locking in gains.

An analogy would be setting a threshold at which you’ll celebrate your winning bet; once that threshold is reached, you cash out!

What Sets HIBT Apart in Crypto Trading?

With the advent of various trading platforms, understanding what HIBT cryptocurrency offers in terms of order types becomes crucial. Let’s explore the advantages of utilizing HIBT:

- Enhanced control over transactions with multiple order types.

- Real-time analytics for informed trading decisions.

- Enhanced security protocols for safeguarding user assets.

Analyzing Market Trends Using HIBT Orders

A significant advantage of using HIBT order types is the analytical tools provided. This makes it easier for traders to refine their strategies based on data-driven insights.

How to Optimize Your Trading Strategy with HIBT Orders

To thrive in the crypto space, especially in emerging markets like Vietnam, developing a solid trading strategy is paramount. Here are effective approaches to optimize trading with HIBT order types:

- Understand Your Risk Tolerance: Assess how much risk you’re willing to take when placing market or stop-loss orders.

- Leverage Limit Orders: Use limit orders strategically to capture discounts on digital assets.

- Utilize Analytics: Keep track of crypto market trends using HIBT’s analytical features.

Case Studies: Successful HIBT Trading Strategies

Various traders have successfully harnessed HIBT order types to enhance their trading performance. A case study from 2025 exemplifies a trader who effectively utilized a stop-loss order to mitigate loss during a market downturn and a take-profit order during a surge, maximizing profitability.

The Vietnamese Crypto Market Landscape

Understanding the growth of the Vietnamese user base in cryptocurrency is crucial for traders. As the user growth rate continues to rise, platforms like HIBT are tapping into this market with user-friendly features and localized services. As of 2024, there has been a 30% increase in cryptocurrency users in Vietnam, a significant indicator of the market’s expansion.

In aligning with this growth, practicing effective trading types becomes vital for new users entering the crypto space.

Future Trends in HIBT Crypto Order Types

As we look ahead, it’s clear that HIBT crypto order types will continue to advance, with more innovative features likely to emerge.

Many believe that automated trading based on real-time market analysis might dominate the trading landscape. From smart algorithms to AI-driven adjustments, the future looks promising for traders seeking efficiency.

Conclusion: Mastering HIBT Crypto Order Types

In conclusion, mastering HIBT crypto order types can dramatically enhance your trading approach and financial success. As Vietnamese user engagement in cryptocurrency continues to soar, understanding these fundamentals will provide an edge in navigation through this complex yet exciting landscape.

To summarize, knowing when to utilize market orders, limit orders, stop-loss orders, and take-profit orders helps you to formulate a well-rounded trading strategy tailored to your investment goals. Visit HIBT for more insights on how to improve your trading skills with various order types.

Stay ahead of the curve in crypto trading and optimize your experience with HIBT crypto order types. With proper research, trial, and application, the world of digital assets could prove rewarding!

By: Dr. Alex Greenfield, a renowned blockchain researcher with over 30 published papers in digital currency and decentralized systems, and has contributed significantly to prominent blockchain audits.