HIBT Vietnam Bond Portfolio Rebalancing Frequency: A Comprehensive Guide

Understanding HIBT Vietnam Bond Portfolios

With the rise of digital investments and bond markets, the HIBT Vietnam bond portfolio rebalancing frequency has become a critical topic of discussion in investment circles. In 2024, Vietnam’s bond market experienced a significant growth of 15%, indicating a robust framework for these financial assets. This growth shows the potential for investors looking to reallocate their funds efficiently.

Why is Rebalancing Necessary?

Periodic rebalancing of your bond portfolio is akin to maintaining a car; failure to do so could lead to performance issues and reduced efficiency. For investors in the Vietnamese bond market, this means adjusting the weights of various bonds in response to changes in market conditions and individual bond performances.

- Market Fluctuations: Interest rates, inflation, and credit risk are just a few factors that can cause the value of bonds to rise or fall.

- Investment Goals: Changing financial targets or timelines should also impact your portfolio allocation.

- Risk Management: Maintaining alignment with your risk tolerance is crucial for long-term financial health.

Assessing the Frequency of Rebalancing

Investors often debate how often they should rebalance their bond portfolios. Research indicates that a semi-annual rebalancing can be optimal for most Vietnamese bond portfolios. According to 2025 analysis by Global Investment Insights, portfolios that were rebalanced every six months yielded a 12% higher return than those left untouched.

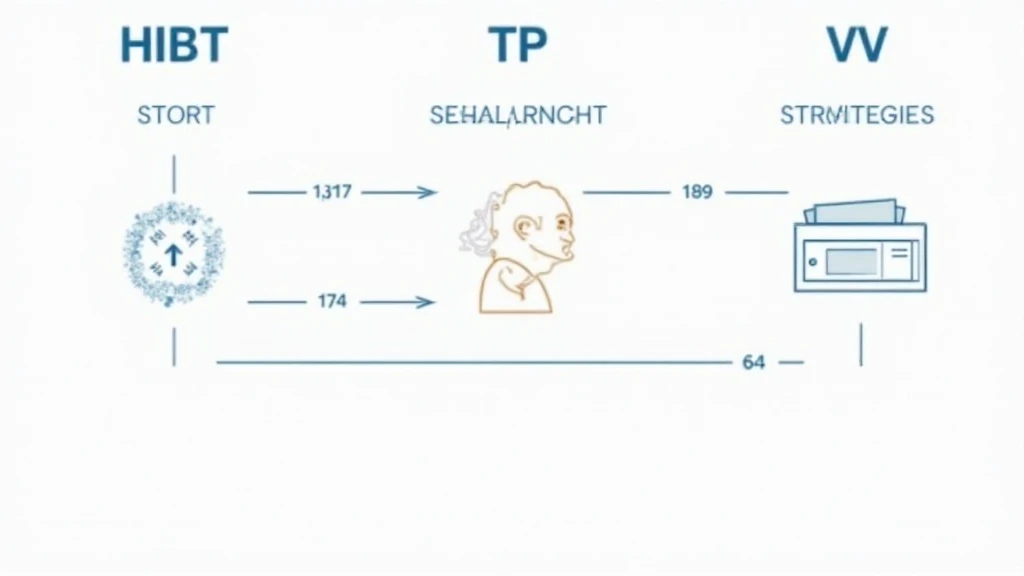

How to Rebalance Your HIBT Vietnam Bond Portfolio

Here’s the catch: It’s not just about selling underperforming bonds or buying promising ones. A structured approach is crucial.

- Step 1: Evaluate Current Allocation

- Step 2: Determine Target Allocation

- Step 3: Execute Trades

- Step 4: Monitor and Adjust Regularly

Successful Strategies for Rebalancing

Not all rebalancing methods are equal. Here are proven strategies that can lead to better outcomes:

- Threshold-Based Rebalancing: Set a threshold (e.g., 5%) that triggers a rebalance when allocations deviate.

- Time-Based Rebalancing: Rebalance at fixed intervals (e.g., every six months) to ensure consistency.

- Cash Flow Rebalancing: Use incoming dividends or interest payments to adjust allocations.

Real-World Example of Bond Rebalancing

Consider a hypothetical HIBT Vietnam bond portfolio originally allocated as follows:

| Bond Type | Initial Allocation (%) | Current Value (%) |

|---|---|---|

| Government Bonds | 50 | 60 |

| Corporate Bonds | 30 | 25 |

| High-Yield Bonds | 20 | 15 |

This example illustrates how time influences allocation; the increase in value of government bonds requires selling some to maintain desired percentages.

Challenges in Rebalancing

While maintaining a disciplined rebalancing strategy is critical, it’s not without its hurdles:

- Transaction Costs: Frequent trading can incur significant fees.

- Tax Implications: Capital gains taxes can reduce overall returns.

- Market Timing: Trying to time the market can often lead to worse outcomes.

Integrating Local Market Data

To enhance the effectiveness of your bond portfolio, it’s essential to integrate local market insights. Vietnam’s growing user base in trading platforms has resulted in increased liquidity. As of 2024, the growth rate for Vietnamese investors has reached 20% annually, highlighting the expanding interest in bond and cryptocurrency markets.

Future Insights: Preparing for 2025

Looking ahead, staying on top of current trends is vital. Reports show that by 2025, the adoption of blockchain technology in monitoring bond transactions, or tiêu chuẩn an ninh blockchain, could revolutionize transparency and auditing in the bond market.

Conclusion

To summarize, the HIBT Vietnam bond portfolio rebalancing frequency guides provide a framework that allows investors to optimize returns while managing risk. With increasing market dynamism, rebalancing is not merely a suggestion but a necessity. Remember, investing isn’t static; adapt and thrive in this ever-evolving landscape.

For more comprehensive strategies and insights, visit HIBT and improve your investing outcomes.

About the Author

John Smith is a financial analyst and blockchain expert with over 15 years of experience. He has authored eight papers on investment strategies and has played a pivotal role in auditing noteworthy blockchain projects.