Understanding HIBT Bitcoin Futures Trading Hours

Introduction

In a world where the cryptocurrency market is rapidly evolving, understanding the intricacies of Bitcoin futures trading is essential for both novice and seasoned investors. Bitcoin futures allow traders to speculate on the future price of Bitcoin without actually owning the asset. With the global rise in cryptocurrency adoption, especially in vibrant markets like Vietnam, knowing the HIBT Bitcoin futures trading hours can significantly impact your trading strategy.

In 2023, around $4.1 billion was lost to DeFi hacks, illustrating the importance of secure trading environments. As we delve deeper into the trading hours for Bitcoin futures, it’s crucial to identify the potential impacts on market volatility and investor strategies.

The Importance of Trading Hours

Trading hours act like a gatekeeper for market participants. They dictate when traders can enter or exit positions, influencing liquidity and volatility. For instance, trading outside of prime hours may result in wider spreads and less favorable pricing.

Here’s a breakdown of why trading hours matter:

- Market Liquidity: High liquidity often correlates to optimal trade execution, ensuring that your orders are filled at the expected prices.

- Volatility: Price changes can be more pronounced outside regular trading hours, which could expose traders to greater risk.

- Market Events: Understanding trading hours allows you to align your strategy with significant market events that could affect price movements.

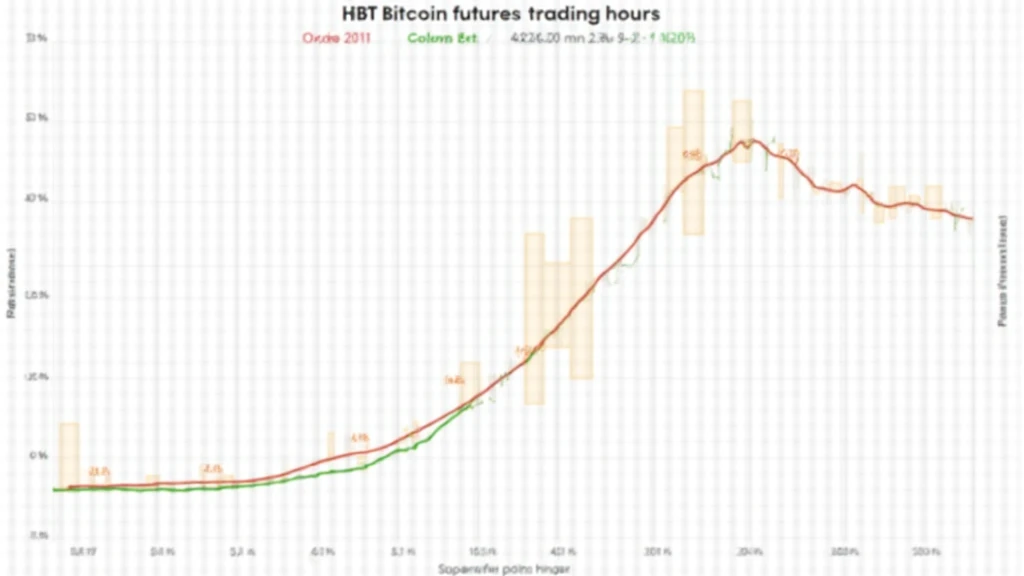

Understanding HIBT Bitcoin Futures Trading Hours

The trading hours for HIBT Bitcoin futures are specifically designed to cater to a global audience, ensuring accessibility across different regions. HIBT allows trading 24/7, but it’s vital to note that there are specific peak periods when trading volume increases.

This schedule effectively mirrors the global demand as the market is never truly closed. Here’s the trading schedule:

| Time Zone | Trading Hours |

|---|---|

| UTC | Always open |

| GMT+7 (Vietnam) | Always open |

As you can see, the 24/7 availability reinforces the importance of staying informed, especially with growing Vietnamese user participation, which has reportedly increased by over 150% in the past year.

Trading Strategies Based on Hours

Different trading strategies can be employed based on the trading hours and market conditions. Here’s how you can optimize your trades:

- Scalping: This strategy thrives during high volatility times; thus, aligning your trades with peak hours can yield better profits.

- Day Trading: Actively managing positions during market open and close can provide tactical advantages, especially if you track news cycles.

- Position Trading: For long-term strategies, use market analysis to determine the most advantageous entry points irrespective of hourly trends.

Market Analysis and Bitcoin Pricing Trends

Understanding trading hours also means keeping a close eye on market analysis and how prices fluctuate during different hours. Data from platforms like coinmarketcap.com can illustrate Bitcoin pricing trends during varying trading periods.

Here’s a summary of average price movements during peak trading hours compared to off-peak hours:

| Trading Period | Average Price Movement (%) |

|---|---|

| Peak Hours | 5%+ |

| Off-Peak Hours | 1%+ |

This data points toward a higher volatility risk during peak hours, making it both a challenge and an opportunity for traders.

Risk Management Strategies

With increased volatility during HIBT Bitcoin futures trading, a robust risk management strategy becomes paramount. Here are some strategies to consider:

- Position Sizing: Determine the size of your positions based on your risk tolerance and market conditions.

- Stop-Loss Orders: Utilize stop-loss to limit your potential losses when a trade goes against you.

- Diversification: Spread your investments across different assets to mitigate risks associated with Bitcoin volatility.

Conclusion

As we navigate the world of cryptocurrency trading, understanding HIBT Bitcoin futures trading hours can play a pivotal role in your trading success. Not only do these hours dictate when you can take action, but they also influence market dynamics and pricing structures.

As the Vietnamese market continues to grow and evolve, it is essential for traders to adapt their strategies and stay informed about market developments. Utilizing trading hours effectively will enhance your trading experience and open new avenues for profitability. Visit HIBT for the latest updates and opportunities.

Written by Dr. Nguyen Hoang, a cryptocurrency expert with over 20 published papers and extensive experience in blockchain project audits, Dr. Hoang brings insights that pave the way for informed trading decisions.