Ethereum Consensus: The Future of Crypto in Vietnam

Ethereum Consensus: The Future of Crypto in Vietnam

As of 2024, the global cryptocurrency market has seen tremendous growth, with over $4.1 billion lost to DeFi hacks, highlighting the necessity for robust security measures. In Vietnam, the cryptocurrency adoption rate has surged, identifying the Ethereum consensus mechanism as a backbone for future developments in the sector. This article dives deep into the Ethereum consensus, examining its implications in Vietnam’s crypto stocks and the emerging trends for 2025 and beyond.

Understanding Ethereum’s Consensus Mechanism

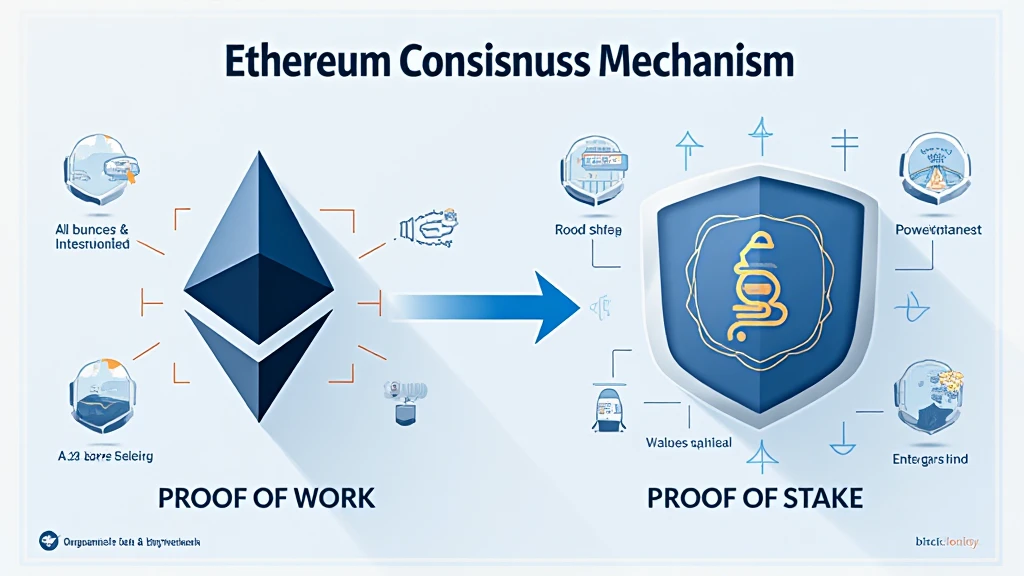

The Ethereum blockchain operates using a consensus mechanism known as Proof of Stake (PoS), which drastically shifted from the previous Proof of Work (PoW) model. This transition not only enhances security but also promotes energy efficiency, making it attractive for investors in Vietnam, particularly with the rising demand for sustainable practices.

- Proof of Stake Overview: Validators replace miners to create new blocks, validating transactions based on the number of coins they hold and are willing to “stake” as collateral.

- Energy Efficiency: PoS potentially reduces the energy consumption of the network by 99.95% compared to PoW, generating a cleaner image for cryptocurrencies.

- Validator Incentives: Stakers earn rewards for participating in securing the network, which can entice a broad spectrum of users, especially in growing markets like Vietnam.

In Vietnam, where cryptocurrency regulations are still evolving, understanding the Ethereum consensus can guide potential investors on how to effectively navigate the landscape of crypto stocks.

The Rising Crypto Market in Vietnam

Vietnam has rapidly emerged as a significant player in the global cryptocurrency market, demonstrated by a growth rate of over 50% in active crypto users in the last year alone. Vietnamese millennials and Gen Z are leading this charge, eager to invest in cryptocurrencies like Ethereum and other altcoins.

- User Demographics: A notable proportion of users are under 30 years old, driving innovation and interest in blockchain technologies.

- Government Initiatives: The Vietnamese government is taking steps towards enhancing blockchain regulation, which could further legitimize the crypto market.

- Investment Opportunities: With crypto stocks on the rise, investors are closely watching companies that leverage Ethereum’s technology for their operations.

As more users adopt Ethereum, it becomes essential to understand the security standards—

“tiêu chuẩn an ninh blockchain”—that will guard their investments.

2025: Trends in Ethereum and Related Crypto Stocks

Looking ahead, the next few years pose exciting trends for Ethereum and crypto stocks. To gain insights, we need to analyze promising developments that could redefine investments:

- Decentralized Finance (DeFi) Growth: DeFi platforms built on Ethereum are attracting billions in liquidity and could offer compelling investment opportunities.

- NFT Market Expansion: The NFT ecosystem using Ethereum could flourish, leading to new tokenization projects and investments.

- Integration with Traditional Finance (TradFi): As banks explore crypto, Ethereum’s framework could serve as the backbone for hybrid models.

With these trends on the horizon, investors must understand how to audit smart contracts to minimize risks associated with DeFi applications.

How to Audit Smart Contracts Effectively

Given the implications of poorly audited smart contracts, developing reliable auditing practices is crucial. Here’s how you can ensure smart contracts are secure:

- Automated Tools: Invest in tools like MythX or Slither that can detect vulnerabilities.

- Peer Reviews: Facilitate audits through developer communities or expert audit firms.

- Continuous Monitoring: Post-deployment monitoring can help catch vulnerabilities early, especially given the dynamic nature of blockchain tech.

This practical approach safeguards investments while navigating the burgeoning Vietnamese crypto market.

Real-Life Case Studies: Ethereum in Action

Analyzing successful projects based on the Ethereum blockchain offers insights into potential investment strategies:

| Project Name | Market Cap (2024) | Key Feature |

|---|---|---|

| Uniswap | $5.2 billion | Decentralized exchange protocol |

| Chainlink | $3.5 billion | Decentralized oracle network |

| Aave | $4.7 billion | Open-source DeFi protocol |

According to 2025 predictions by Chainalysis, innovations like these could become pivotal for Vietnamese investors seeking security in crypto stocks.

Conclusion: Investing Smart with Ethereum in Vietnam

Investing in Ethereum and related crypto stocks in Vietnam represents an opportunity to join a rapidly growing market. With an increasing user base and government support, understanding the dynamics of Ethereum’s consensus and effective investment practices is vital. Experts recommend adopting a cautious approach, continuously updating knowledge on security protocols, and ensuring a diversified investment portfolio.

As we delve into the future, it’s essential to stay informed about emerging trends and regulatory shifts that could impact investments. Be sure to seek advice from trusted sources and conduct thorough research before making investment decisions in a volatile market like cryptocurrency.

For all your crypto news and crypto stocks analysis, visit techcryptodigest to stay ahead in this evolving landscape.

Author: Dr. Nguyen Tran, a blockchain technology expert with over 20 published papers and leading several high-profile smart contract audits.