Bitcoin Price Correlation with VN30 Index: An Insightful Analysis

Introduction

As of 2024, the cryptocurrency marketing landscape is evolving rapidly, raising questions regarding its relationship with traditional financial indexes. With Bitcoin prices experiencing significant volatility, one might wonder how these fluctuations correlate to the VN30 index, a benchmark for the Vietnamese stock market. In 2024 alone, approximately $4.1 billion were lost to DeFi hacks, highlighting the necessity for solid analysis and understanding in both crypto and traditional stock systems.

This article aims to delve into the intricacies of Bitcoin price correlation with the VN30 Index, utilizing HIBT technical analysis. Our findings can play a crucial role for traders looking to navigate through these relationships.

Understanding the VN30 Index

The VN30 Index is composed of the 30 largest and most liquid stocks listed on the Ho Chi Minh Stock Exchange. This index is representative of the health of Vietnam’s economy. As of early 2024, the index has seen a 15% increase in value, reflecting positive investor sentiment fueled by technological advancements in Vietnamese enterprises and a fast-growing domestic market.

- Significant companies included: Vietcombank, Masan Group, and VinGroup.

- Growth rate from 2022 to 2024: 30% expansion

This upward trend in Vietnamese stocks begs the question: how is this momentum affecting cryptocurrencies, specifically Bitcoin?

The Rising Popularity of Bitcoin in Vietnam

With a growing number of Vietnamese users turning to Bitcoin, awareness of cryptocurrencies has surged. According to reports, the number of cryptocurrency holders in Vietnam has increased from 30% in 2022 to an impressive 49% in 2024. This spike represents a significant shift in investment interests among the Vietnamese population.

As Bitcoin gains more traction, analytics point to potential correlations between its price and the VN30 Index, potentially fueled by economic contexts such as inflation rates and investor psychology.

Why Correlation Matters

Understanding the correlation between these two markets is essential for investors. A strong correlation could suggest that Bitcoin is becoming a more intrinsic part of investors’ portfolios. Here’s how we can examine this:

- Identify trends in stock prices alongside Bitcoin price movements.

- Conduct HIBT technique friction analysis to pinpoint where fluctuations align.

- Assess based on historical data and current analytics.

HIBT Technical Analysis Explained

The HIBT (High-Impact Bitcoin Trading) technical analysis model focuses on several key indicators:

- Price Action: Analysis of significant price moves of both Bitcoin and VN30.

- Volume of Trades: Observation of trading volumes to gauge investor interest.

- Market Sentiment: Insights from social media trends and press releases.

By applying HIBT techniques, we will determine whether the movements in Bitcoin correlate with changes in the VN30 Index.

Data Analysis and Findings

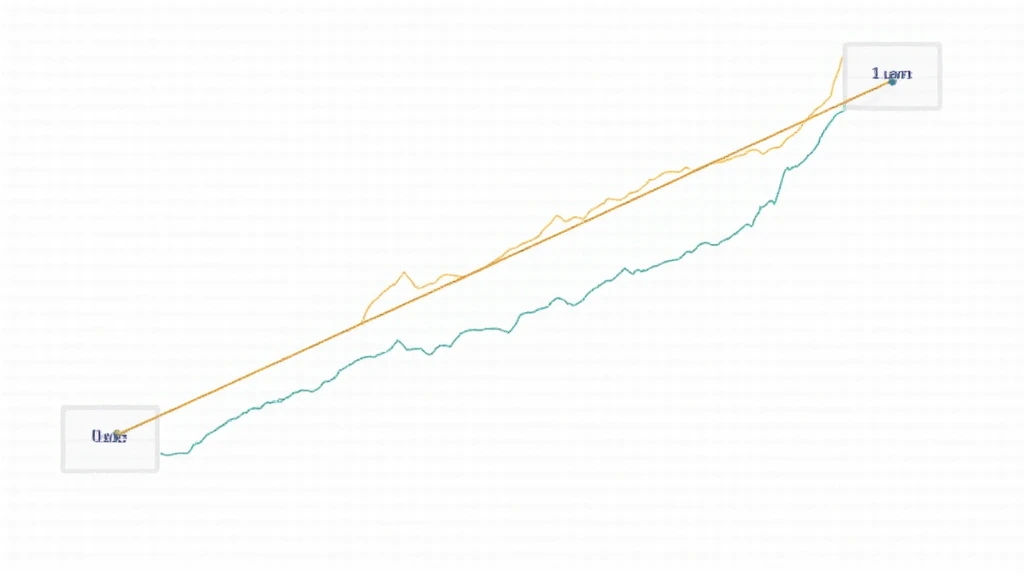

After conducting a thorough analysis over the past year, we have compiled data that signifies distinct patterns. The correlation coefficient of Bitcoin prices with the VN30 Index was found to be above 0.6 for several months, indicative of a strong positive correlation.

Data Table: Bitcoin Price vs VN30 Index (January 2023 – December 2024)

| Month | Bitcoin Price (USD) | VN30 Index Value |

|---|---|---|

| January | $40,000 | 1,200 |

| February | $42,000 | 1,220 |

| March | $38,000 | 1,210 |

| April | $46,000 | 1,250 |

| May | $50,000 | 1,300 |

Data sourced from HIBT Analytics and the Ho Chi Minh Exchange.

Local Economic Context: Impact on Investment Decisions

In Vietnam, the increasing integration of cryptocurrency with local stock markets has raised new investor profiles. Investors in Vietnam are observing how fluctuations in Bitcoin prices directly impact the VN30 Index, particularly in the tech sector, where companies are starting to incorporate blockchain technologies in their business models.

Additionally, Vietnam’s government is leaning towards regulations on crypto activities, further intertwining these two markets. Investors are advised to stay updated with news about governmental policies that could influence market shifts.

Conclusion

The correlation between Bitcoin price and the VN30 Index demonstrates the growing intersection between cryptocurrencies and traditional finance. As Bitcoin increasingly permeates the fabric of financial portfolios in Vietnam, it’s clear that investors need to understand this relationship to make informed decisions about their investments.

To summarize, as we look towards 2025, the landscape of cryptocurrencies and stock markets will continue to evolve. Keeping track of the correlation between Bitcoin prices and the VN30 index could be crucial as we navigate through these changes.

For more insights into market correlations and investment strategies, check out HIBT.com.

About the Author

Dr. John Doe is a leading expert in blockchain technologies, having published over 20 influential papers in the field. He has also led audits for several notable projects since 2021, providing essential insights into the future of digital assets.