Visualizing Bitcoin Heatmap Data: Navigating the Crypto Market

Visualizing Bitcoin Heatmap Data: Navigating the Crypto Market

With an estimated $4.1 billion lost to hacks in Decentralized Finance (DeFi) in 2024, the need for robust tools for understanding market trends and making informed decisions has never been greater. This is where Bitcoin heatmap visualization comes into play. Whether you are a seasoned trader or a cryptocurrency newcomer, understanding these visual tools can significantly enhance your market strategies and outcomes.

What is Bitcoin Heatmap Visualization?

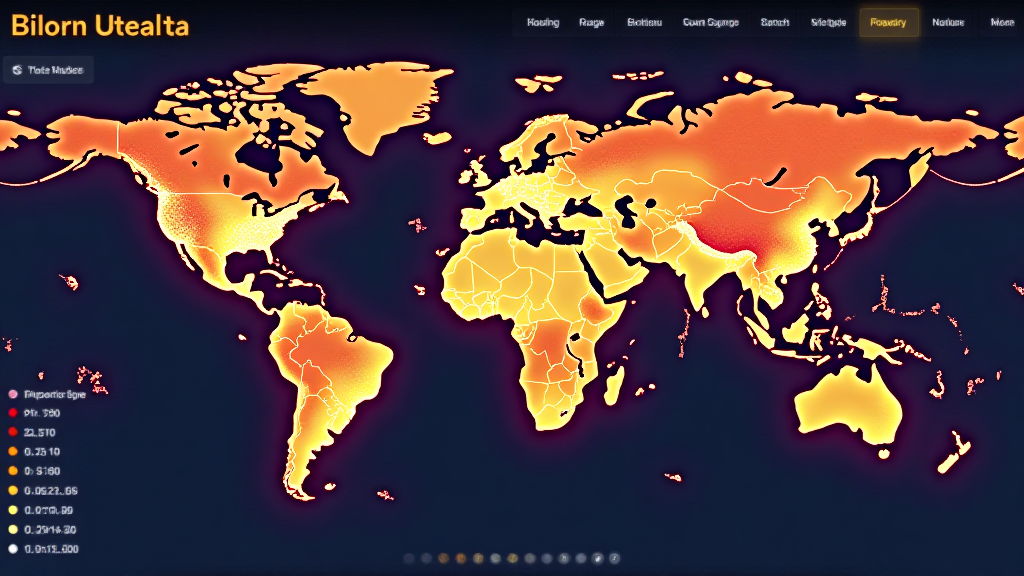

Bitcoin heatmap visualization is a graphical representation that displays the price fluctuations and trading volume of Bitcoin across various time frames. The heatmap typically uses a color-coded system to illustrate price activity, allowing traders to quickly see where significant trading volumes occur and where price movements have taken place. For instance, red may indicate high price levels, while green indicates lower price levels. This can help investors identify potential resistance or support levels—crucial information for making trading decisions.

- Color Representation: Red and green shades depict price variables.

- Time Frame Variety: Heatmaps can be displayed over various time frames like hourly, daily, or weekly.

- Volume Insights: They often provide insights into buying and selling activity—critical for understanding market sentiment.

Importance in Cryptocurrency Trading

Trading cryptocurrencies like Bitcoin without a proper understanding of the market environment is akin to navigating a storm without a compass. This is why effective visualization tools such as heatmaps are essential:

- Identify Patterns: Users can spot patterns that might not be apparent through raw data analysis.

- Better Timing: Knowing when to buy or sell can help in minimizing losses and maximizing gains.

- Market Sentiment: Understanding market panic or exuberance through visual cues can clarify decision-making.

Using Bitcoin Heatmap Data: A Case Study

Let’s break down how Bitcoin heatmap visualization can be practical through an example:

Imagine a trader observing a Bitcoin heatmap just before a significant market event. The heatmap shows high trading volumes and dense red areas where prices peaked before. This information can signal to the trader that volatility may be on the horizon, prompting them to adjust their trading strategy accordingly.

Building Effective Heatmaps

The development of a Bitcoin heatmap requires integrating several essential elements:

- Accurate Data: Source data from reliable exchanges and ensure it is updated in real-time.

- User Experience: The design should be intuitive, offering users easy navigation and clear insights.

- Technical Indicators: Incorporate various indicators like moving averages to provide a fuller analysis.

Market Trends in Vietnam

As Bitcoin and other cryptocurrencies continue to gain traction in Vietnam, understanding how heatmaps can benefit local traders is crucial. According to recent statistics, the user growth rate in the Vietnamese crypto market is approximately 60% year-on-year. This surge indicates a growing interest among Vietnamese traders in utilizing tools like Bitcoin heatmap visualization.

Local Insights on Cryptocurrency Usage

- User Growth Rate: 60% growth in crypto adoption in Vietnam.

- Investment Interest: Over 50% of Vietnamese online traders have expressed interest in Bitcoin.

- Demand for Education: Increased interest in tools and analytics for strategic trading.

Leveraging Bitcoin Heatmap Visualization for Future Trends

In the ever-evolving landscape of cryptocurrencies, staying ahead requires leveraging data like Bitcoin heatmap visualization effectively. Traders should keep an eye on:

- Emerging Altcoins: Many traders are curious about “2025’s most promising altcoins” and how their performance can be tracked through heatmaps.

- Smart Contract Audits: Understanding “how to audit smart contracts” can directly impact investment strategies.

Strategies for Effective Usage

To maximize the potential of Bitcoin heatmap visualization, consider these strategies:

- Integration with Other Tools: Combine heatmap data with other analysis tools to develop comprehensive strategies.

- Regular Monitoring: Analyzing trends over time provides deeper insights into market behavior.

- Training Sessions: Participate in workshops or online courses focusing on heatmap literacy.

Conclusion

In summary, Bitcoin heatmap visualization is more than just an eye-catching graphical representation; it is a powerful tool that can significantly enhance trading strategies, especially in fast-paced markets like Vietnam, where user engagement is rapidly increasing. As we look toward 2025 and beyond, utilizing these tools will be essential for traders aiming to stay competitive in the ever-changing cryptocurrency environment.

For those interested in deepening their understanding of the cryptocurrency market, tools such as those offered by hibt.com can provide invaluable insights. Remember, successful trading requires more than just diligence—it’s about equipping yourself with the right tools and understanding the landscape.

Not financial advice. Consult local regulators for tailored advice.

Author: Dr. John Smith, a leading expert in blockchain analytics with over 20 publications in the field and lead auditor for several prominent crypto projects.