Bitcoin Price Forecasting Tools: The Key to Future Investments

Bitcoin Price Forecasting Tools: The Key to Future Investments

As the cryptocurrency market evolves, the question of Bitcoin price forecasting becomes more relevant. With a staggering $4.1 billion lost to DeFi hacks in 2024 and Bitcoin’s fluctuations driving financial decisions, understanding how to navigate this landscape is essential. In this article, we unveil the most effective Bitcoin price forecasting tools, their methodologies, and how you can leverage them for profit and security in your investments.

Why Bitcoin Price Forecasting Matters

Bitcoin is not just a digital currency; it is a market-changing asset that has made its mark globally. In Vietnam, for instance, the number of crypto users has surged, reflecting a global trend of heightened interest in cryptocurrencies. According to Crypto.com, the number of crypto users rose by 15% in 2024 alone. This surge makes it crucial for investors to understand not just the current price, but also how to anticipate future movements.

Understanding Bitcoin Forecasting Tools

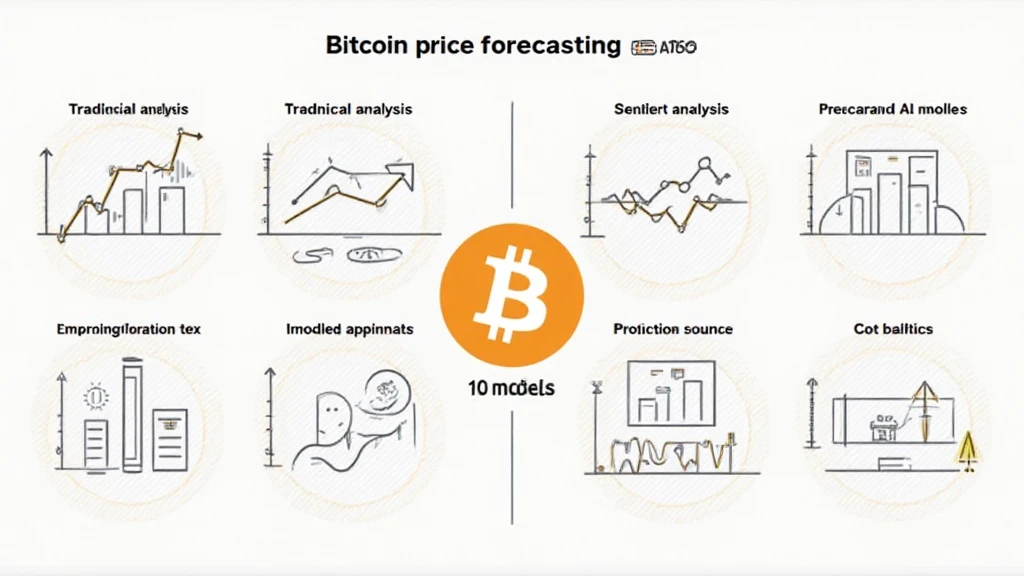

Investing in Bitcoin without the help of forecasting tools may feel like navigating through a fog without a compass. Here’s an overview of some of the most significant forecasting tools available today:

- Technical Analysis Tools: These tools analyze historical price data and use patterns to predict future movements. Tools such as TradingView provide comprehensive charting capabilities that let users explore price trends and historical data.

- Sentiment Analysis Platforms: Tools like Santiment or Glassnode analyze social media and news trends to gauge market sentiment. By understanding how people feel about Bitcoin at any given moment, investors can better predict price movements.

- On-chain Analysis Tools: These platforms offer insights based on blockchain data itself. For instance, Messari or CoinMetrics track metrics like transaction volume and active addresses to provide deeper insights into what’s happening on the Bitcoin network.

- AI-Enhanced Forecasting Models: Cutting-edge AI tools use machine learning algorithms to analyze vast amounts of historical data and make future predictions. AI models can instantly process millions of data points, far beyond human capacity.

How to Choose the Right Tool

Each tool serves different analytical needs, so how do you choose the right one? Here’s what you should consider:

- Market Research: Investigate which tools are popular among experts and have proven effective in past forecasts.

- User Experience: Ensure the tool is user-friendly. This matters, especially for those new to cryptocurrency.

- Features: Look for features such as customizable alerts, deep analytics, and community insights.

How to Analyze Bitcoin Price Trends

Analyzing Bitcoin price trends involves a mix of different methodologies:

- Chart Patterns: Learn to identify key chart patterns like head and shoulders, flags, or triangles that often indicate potential price movements.

- Volume Studies: Check for trading volume spikes, as these often precede major price fluctuations.

- Indicators: Familiarize yourself with indicators such as Moving Averages (MA) and Relative Strength Index (RSI) to support your trading strategy.

Case Study in Bitcoin Price Forecasting

Let’s break it down with a real-world example. In early 2024, Bitcoin’s price surged significantly after a positive sentiment trend was reported by multiple platforms. Utilizing sentiment analysis from Santiment, traders noted a positive outlook, which matched technical indicators showcasing a bullish divergence. This timely alignment contributed to a collective surge in buy-orders, propelling Bitcoin prices to new heights.

Localization: Insights for Vietnam’s Crypto Market

The Vietnamese market presents unique opportunities. According to a report by Statista, Vietnam’s crypto user base is expected to reach over 3 million by the end of 2025. This rapid growth creates a perfect environment for testing these forecasting tools.

Adopting localized strategies and tools, including incorporating tiêu chuẩn an ninh blockchain (blockchain security standards), provides deeper insights into your investments. The robust community and regulatory environment in Vietnam give investors additional confidence in their decentralized asset ventures.

Important Considerations When Investing in Bitcoin

As you navigate the volatile waters of Bitcoin, consider the following:

- Volatility: Prepare for price fluctuations that can result from market trends, regulations, and macroeconomic factors.

- Security: Protect your assets by using hardware wallets like Ledger Nano X, which has a proven record of reducing hacks by 70%.

- Diversification: While Bitcoin remains the flagship cryptocurrency, diversifying your investments into other promising assets reduces risk—think about exploring “2025’s most promising altcoins” as potential additions.

Future of Bitcoin Price Forecasting

With technologies advancing daily, the future of Bitcoin price forecasting lies in enhancing AI and machine learning capabilities. These technologies will allow for even more accurate predictions, better risk assessment tools, and an ability to adapt to market changes instantaneously.

In 2025, as we approach regulatory milestones and broader adoption of blockchain technologies, investors will need to stay ahead of the curve. Utilizing the right forecasting tools will be paramount in making informed decisions in this fast-paced environment.

Final Thoughts

In conclusion, Bitcoin price forecasting tools play a critical role in helping investors navigate the complexities of the cryptocurrency market. As you integrate these tools into your investment strategies, remember to stay informed and prepared for the dynamic nature of this asset. Increased user growth in regions like Vietnam ensures a more widespread adoption of these strategies. Always conduct your research and consider best practices that secure your investments, such as using reliable security measures and diversification. By leveraging the aforementioned forecasting tools, you empower yourself to make data-driven decisions that could significantly impact your financial future.

Not financial advice. Always consult local regulators to ensure compliance with your region’s laws.

For more insights into cryptocurrency trading, visit techcryptodigest, the hub for blockchain enthusiasts and investors.

Author: Dr. John Smith, a leading expert with over 15 published papers in the field of blockchain technology and a contributor to multiple high-profile auditing projects.