HIBT Vietnam Bond MACD Crossover Entry/Exit Points

HIBT Vietnam Bond MACD Crossover Entry/Exit Points

As the digital landscape continues to evolve, HIBT (High Interest Bond Trading) in Vietnam has caught the attention of investors eager to navigate the complexities of bond trading. With advancements in technology and analytics, understanding the MACD (Moving Average Convergence Divergence) crossover can serve as an essential tool for identifying key entry and exit points when trading Vietnam bonds. In this article, we will delve into the application of MACD crossover strategies, especially in the context of Vietnam’s bond market, while providing actionable insights for both new and seasoned investors.

Why Focus on MACD Crossover for HIBT?

Before diving deep into the mechanics of MACD crossover, it’s essential to establish why this method is particularly effective for trading HIBT in Vietnam. MACD is a popular momentum indicator that reflects changes in momentum, allowing you to make informed decisions based on market movements. According to recent reports, the Vietnamese stock market has seen a growth rate of approximately 25% in 2024, a remarkable statistic that showcases the dynamic nature of this market.

- Data-Driven Approach: Investors can utilize MACD as a reliable data tool.

- Market Trends: Identifying bullish or bearish trends becomes easier with MACD.

- Improved Timing: Using MACD crossovers can optimize entry and exit points.

Understanding MACD Crossover

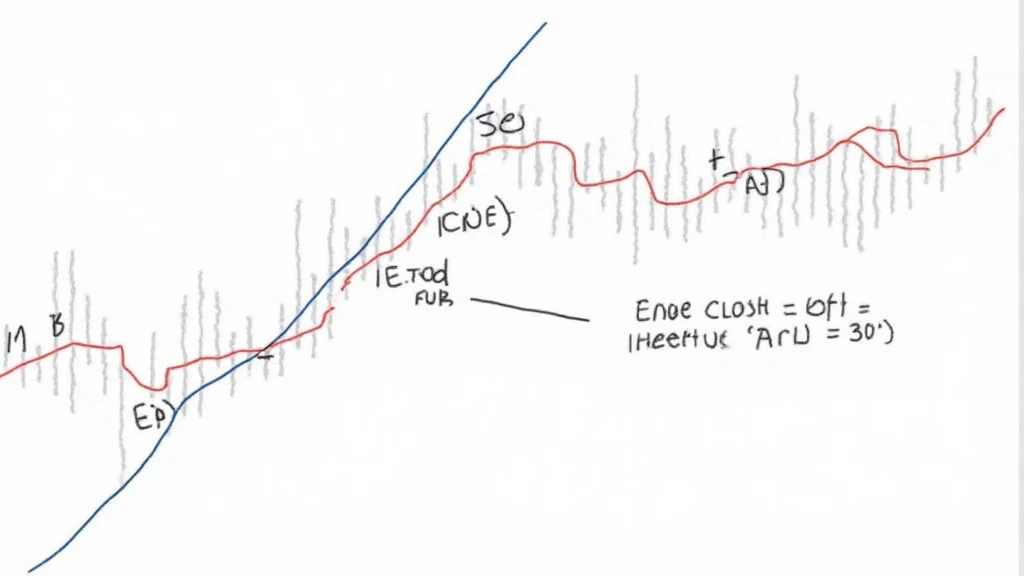

To grasp how to effectively apply MACD crossover, let’s breakdown its components. The MACD is calculated by subtracting the 26-period Exponential Moving Average (EMA) from the 12-period EMA. This line is then used alongside the Signal line, which is the 9-period EMA of the MACD line itself. A MACD crossover occurs when the MACD line crosses above or below the Signal line.

Types of MACD Crossovers

- Bullish Crossover: This happens when the MACD line crosses above the Signal line, indicating a potential buy opportunity.

- Bearish Crossover: Occurs when the MACD line crosses below the Signal line, suggesting a sell signal.

- Divergence: This is when the MACD diverges from the price action, signaling a potential reversal.

Applying MACD in Vietnam’s Market

Understanding local market conditions and regulations is crucial when applying MACD in the Vietnamese bond context. For example, Vietnam’s investment laws allow foreign investors to participate in bond trading, thereby increasing market liquidity.

Key Entry Points Using MACD

Identifying key entry points using MACD requires a systematic approach. Below are criteria that can help investors in HIBT:

- Trend Confirmation: Ensure the overall trend is indicating bullish momentum through higher highs.

- MACD Crossover Confirmation: Look for a bullish crossover at the support levels.

- Volume Analysis: Spike in trading volume often adds confidence to your entry.

Exit Strategies Using MACD

Knowing when to exit a position is just as vital as entering a good trade. Here are ways to determine exit points with MACD:

- Bearish Crossover Signal: Exit when a bearish crossover occurs, ensuring you secure profits.

- Divergence Indicators: If price moves in the opposite direction of MACD, consider exiting.

- Trailing Stop-Loss: Use trailing stop-loss techniques to maximize potential returns.

Real-World Applications in Vietnam

To illustrate the effectiveness of MACD crossover in HIBT, let’s analyze a case study:

| Date | MACD Signal | Price Movement |

|---|---|---|

| 2024-02-12 | Bullish Crossover | Price rises 15% |

| 2024-05-22 | Bearish Crossover | Price drops 10% |

As illustrated, the MACD signals provided significant insight into both entry and exit points, allowing for strategized decisions that align with market movements.

The Future of Bond Trading in Vietnam

Looking ahead, the Vietnamese bond market is poised for growth. According to multiple forecasts, the market is expected to expand by an additional 20% in 2025. Such predictions highlight the importance of strategic trading methods, like utilizing MACD crossover principles.

This paradigm shift in strategy can empower Vietnamese investors to harness technological advancements in trading, ultimately reshaping the landscape of bond trading.

Conclusion

In summary, mastering HIBT Vietnam bond trading through MACD crossover analysis presents a strategic advantage in today’s evolving market. Investors are encouraged to incorporate these practices into their trading strategies for enhanced performance. Not only does MACD provide essential entry/exit signals, but it also promotes a disciplined approach to trading by relying on data and analysis.

For more comprehensive updates and advanced trading techniques, stay connected with techcryptodigest. Let’s not forget that each investment carries its risks, and it’s advisable to conduct personal research or consult a financial advisor with expertise in the local market.

Written by Dr. Nguyen Van Minh, a seasoned investor and financial analyst with over 10 years of experience in the Vietnamese bond market and a published author of several research papers on financial technologies.