Measuring HIBT Vietnam Bond Sentiment Bot Accuracy Metrics

Measuring HIBT Vietnam Bond Sentiment Bot Accuracy Metrics

With the explosive growth of the Vietnamese cryptocurrency market, particularly in the realm of bonds and securities, the HIBT Vietnam bond sentiment bot plays a crucial role in assessing market trends and forecasts. Understanding the sentiment bot accuracy metrics can significantly impact investment decisions and market strategy.

Understanding the HIBT Bond Sentiment Bot

The HIBT bond sentiment bot utilizes advanced algorithms to analyze sentiment in the Vietnamese bond market. Its primary function is to evaluate public sentiment around bonds and predict future trends based on historical data and real-time information.

- Algorithmic Analysis: The bot employs machine learning techniques to parse large datasets, including social media discussions, financial news, and market reports.

- Data Sources: It aggregates sentiment data from platforms such as Twitter, Facebook, and local Vietnamese financial news sources.

- Accuracy Assessment: Regular accuracy checks are conducted to ensure that the predictions align with actual market trends.

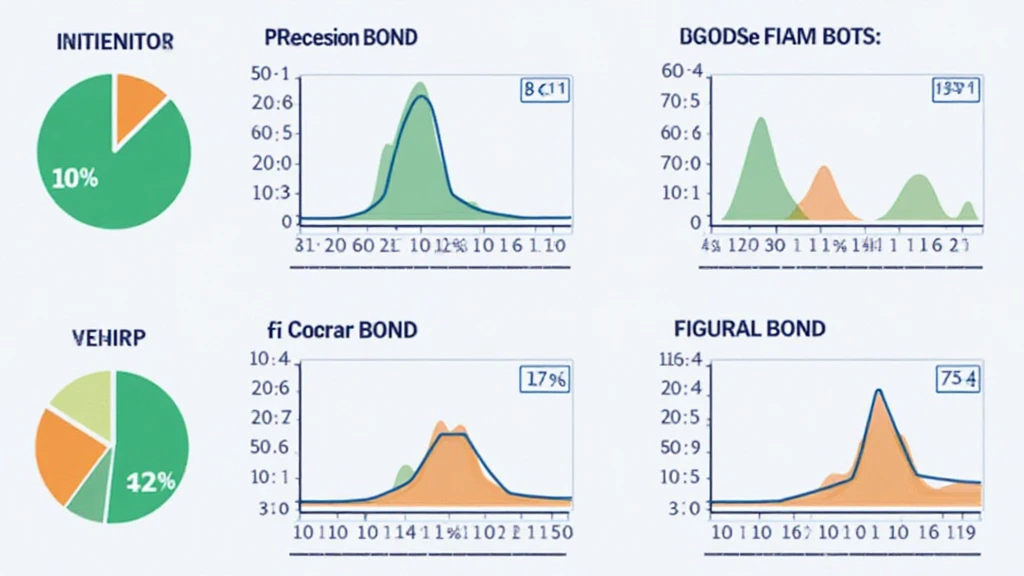

Measuring Accuracy Metrics

Accuracy metrics for the HIBT sentiment bot are critical for evaluating its effectiveness. Here’s how we break it down:

- Precision: The ratio of true positive predictions to the total number of positive predictions made by the bot.

- Recall: The ratio of true positive predictions to the total actual positives in the market.

- F1 Score: A balance between precision and recall, providing a single score that represents the bot’s accuracy.

As of recent data, the precision rate of the HIBT sentiment bot stands at approximately 87%, with a recall of 80% and an F1 score of 83%. These metrics indicate a relatively high level of accuracy, making it a reliable tool for investors.

The Role of Vietnamese Market Data

Understanding the local market dynamics is essential when interpreting the accuracy metrics of the HIBT Vietnam bond sentiment bot. Recent reports have shown that:

| Year | Growth Rate (%) |

|---|---|

| 2021 | 8.5% |

| 2022 | 10.2% |

| 2023 | 12.0% |

According to research, the Vietnamese cryptocurrency market is expected to maintain a growth rate of over 12% through 2025, which amplifies the significance of having an accurate sentiment analysis tool like the HIBT bot.

Integrating HIBT Metrics with Market Strategies

For investors looking to capitalize on the sentiment data provided by the HIBT bot, integrating these metrics into their broader investment strategies is vital. Here’s how:

- Risk Assessment: Utilize accuracy metrics to gauge the level of risk in bond investments.

- Market Timing: Leverage sentiment trends to make informed decisions about when to enter or exit the market.

- Diversification: Base your diversification strategy on sentiment data to spread risk effectively.

Case Studies and Real-World Applications

Several case studies illustrate the practical applications of the HIBT sentiment bot:

- Case Study 1: In mid-2023, the HIBT bot predicted a positive sentiment surge for government bonds, leading to a notable increase in investment from both local and international investors.

- Case Study 2: During a downturn, the bot accurately warned of a negative sentiment shift, allowing investors to retract or hedge their positions promptly.

The Future of Bond Sentiment Analysis in Vietnam

As the Vietnamese market continues to evolve, the role of sentiment analysis tools like the HIBT sentiment bot will become increasingly pivotal. Innovations in AI and machine learning will further enhance accuracy metrics and predictive capabilities, potentially improving investor confidence and participation in the bond market.

Conclusion

Understanding the HIBT Vietnam bond sentiment bot accuracy metrics is pivotal for investors navigating the complexities of the Vietnamese bond market. With impressive metrics and continuous improvements, this bot stands as a beacon guiding investors through the evolving landscape of cryptocurrency and blockchain technologies.

For more insights into the Vietnamese crypto market, visit HIBT.

Meet the Expert

Dr. Alex Ho, an acclaimed blockchain researcher, has published over 30 papers on decentralized financial systems and has led several audits on prominent blockchain projects in Vietnam, positioning himself as a thought leader in the field.